AXI IMMO / Warehouses / Śląskie / Bytom /

SBU - small business units with office space in Bytom

Warehouse spaces with office part close to A1 motorway

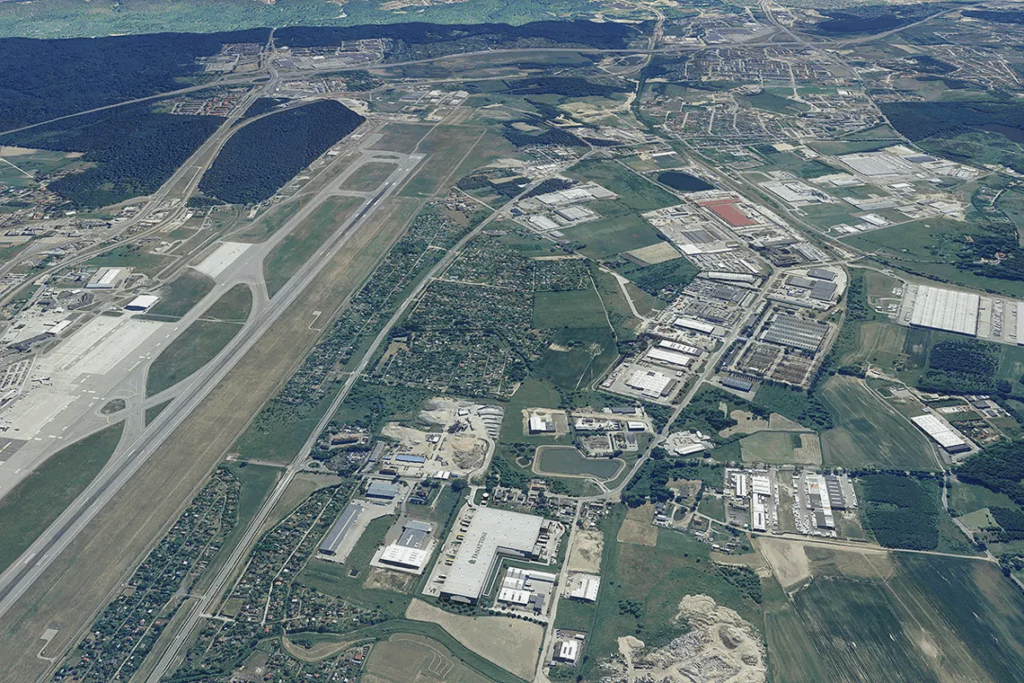

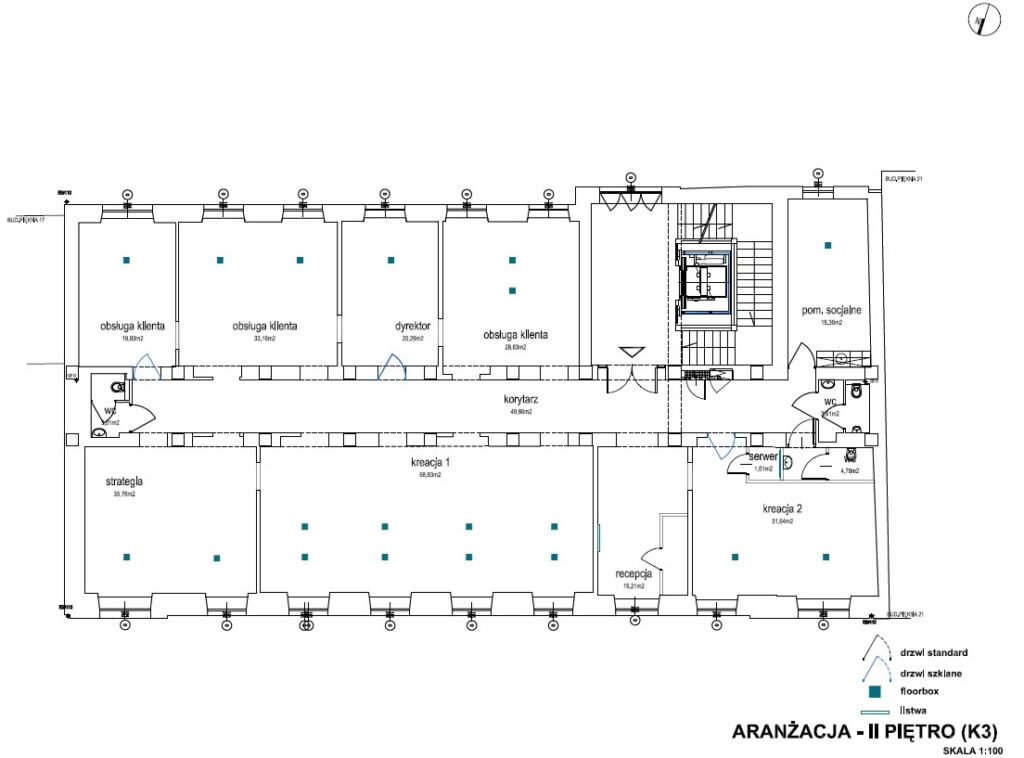

Modern SBU warehouse halls will be built in Bytom directly at the A1 Motorway junction. An excellent location in the center of the Silesian agglomeration, just 20 km from the Katowice airport and with a good connection to public transport, provides excellent and flexible conditions for the development of many industries, including e-commerce, last mile logistics, self storage or even light production. Small modules of approx. 300 m2 with an office part and a showroom, fully finished with dedicated parking spaces, are ideal formats for business and direct sales. The owner provides space adapted to the tenant, along with full protection and insurance, the possibility of expansion and a dedicated manager.

Small warehouse, office and exhibition modules The building is scheduled for delivery in 2022 Zero level gates Parking for cars and trucks Possibility of light production The storage height is 6.5 m Dust-free floor Floor loading capacity 5 T / sq m. Showroom Fully finished surfaces Monitoring 24/7 security

Location

Warehouses in Bytom, northwest of Katowice, province Silesian Warehouse space at the A1 motorway junction Perfect location in the center of the Silesian agglomeration Just 20 km from Katowice airport Good public transport connection Perfect and flexible conditions for the development of many industries, including e-commerce, last mile logistics, self storage or even light production

Technical data

- Number of buildings1

- Possibility of productionYES

- CertificateNO

- Storage height (m)6.5

- Floor load capacity5.0

- Column grid-

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance-

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)-

- Minimal space (sq m)300

- Roof SkylightsNO

- SprinklersNO

- MonitoringYES

- SecurityNO

- Offer IDmm2414

Developer

PROPCO is a leading developer on the market of small-format commercial real estate. In its activities, PROPCO provides the market with an original design of Small Business Units as well as development projects dedicated to operators of the last mile logistics sector, fully supporting the investment and management process and cooperating with both Polish and international institutional investors. PROPCO is one of the few entities in Poland regulated by the Royal Institution of Chartered Surveyors - one of the key professional organizations in the construction and real estate industry in the world.

Distances

Market data

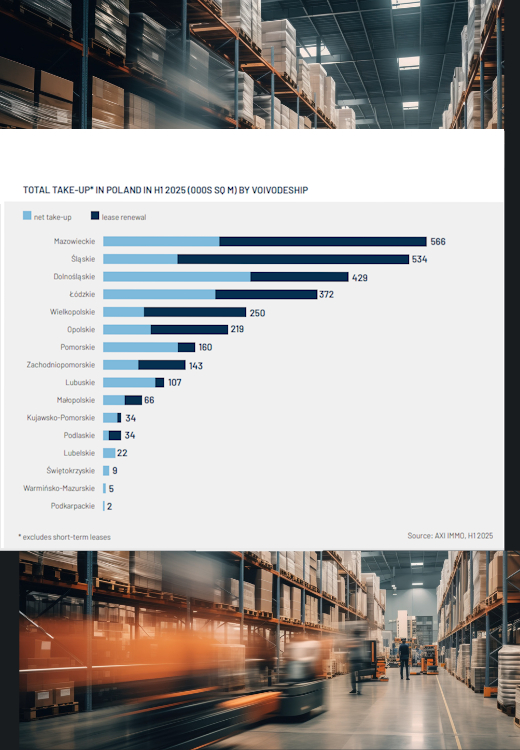

The Silesian voivodeship, with Katowice as its main centre, maintains its status as one of the largest and most liquid warehouse markets in the country.

By combining extensive road infrastructure with a vast stock of modern space, the region remains a key point on the Central European distribution map, serving both international and domestic logistics operators, retail chains, and manufacturing companies.

In the first half of 2025, gross demand for warehouse space in Silesia amounted to 534,000 sq m (2nd place in Poland), of which as much as 76% consisted of extensions of existing lease agreements—confirming the maturity of the market and the process of renegotiation among tenants with long-term contracts. Net demand—new contracts and expansions—was significant despite the overall downward trend in the country.

In H1 2025, developers delivered 256,000 sq m of modern warehouse space in Upper Silesia (2nd place nationwide). As of the end of June 2025, around 200,000 sq m remained under construction, with flagship projects including Panattoni Park Sosnowiec Expo (62,100 sq m), BOOSTER ZABRZE by LemonTree (41,000 sq m), and EQT Exeter Gliwice (36,100 sq m). Despite a decrease in speculative investments, Upper Silesia retains a high level of new developments, thanks to the strength of its local tenant base.

The vacancy rate at the end of June 2025 stands below the national average, at 7.0%, confirming strong space absorption and a stable tenancy structure. Asking rents in new big-box developments in the region range from €4.30 to €4.60/sq m/month, while older projects can be rented for around €4.00/sq m/month. For larger transactions, tenants can expect package deals and attractive effective conditions.

The main tenant groups in the region are manufacturing companies, e-commerce, retail chains, logistics operators, and entities from the distribution and FMCG sectors. The high proportion of lease renegotiations and the presence of global investors and operators confirm the maturity and long-term appeal of Upper Silesia for industrial and logistics business.

The above data comes from the AXI IMMO report 'Warehouse Market in Poland H1 2025'.