AXI IMMO / Warehouses / Trójmiasto / Gdynia /

7R City Flex Gdynia warehouse to lease near the Tricity bypass, northern Poland

City warehouse to lease in Gdynia near S7 Expressway

The 7R City Flex Gdynia urban warehouse property is located within the city of Gdynia.

Attractive location thanks to wide access to urban infrastructure and proximity to the S7 expressway, which is the main ring road of the Tri-City agglomeration.

To lease a warehouse space, A-class

Steel structure hall

Heating

Modern LED lighting

storage height 10 m

Floor load capacity 5 T/sqm

Pole grid 12x24 m

Docks

Zero level gates

Sprinklers

Ample parking and maneuvering area

The area of the property is well-kept and hardened

The property is fenced.

Location

Warehouse at the Tri-City Ring Road - S7 road The park is located within the city of Gdynia; Good connection to the A2 motorway; Access to the airport in Gdańsk within 35 minutes; Quick access to the main cities of Poland - Poznań, Wrocław, Łódź, Warsaw and Szczecin; Access to qualified staff.

Technical data

- Number of buildings1

- Possibility of productionYES

- CertificateYES

- Storage height (m)10

- Floor load capacity5

- Column grid24 x 12

- Railway sidingNO

- Availability of office spaceNO

- Fire resistanceDocksYESGround level access doorsYESCold store/freezerNOOffice space (sq m)-Minimal space (sq m)2000Roof SkylightsYESSprinklersYESMonitoringYESSecurityNOOffer IDmp11076

Developer

7R SA offers modern warehouse and logistic space adapted to the needs of the most demanding sectors of the economy. These are warehouse halls of the City Flex Last Mile Logistics series, as well as of the BTS type in urban locations and in the industrial basins of key cities in Poland.

Distances

Market data

The Tri-City (Gdańsk Region), with its main warehouse hubs in the Pomeranian voivodeship area, is consolidating its position as one of the most dynamic markets in northern Poland. Its location on major transit routes, along with the proximity to seaports and transshipment terminals, means the region is preferred by international logistics operators, manufacturing companies, and the e-commerce sector.

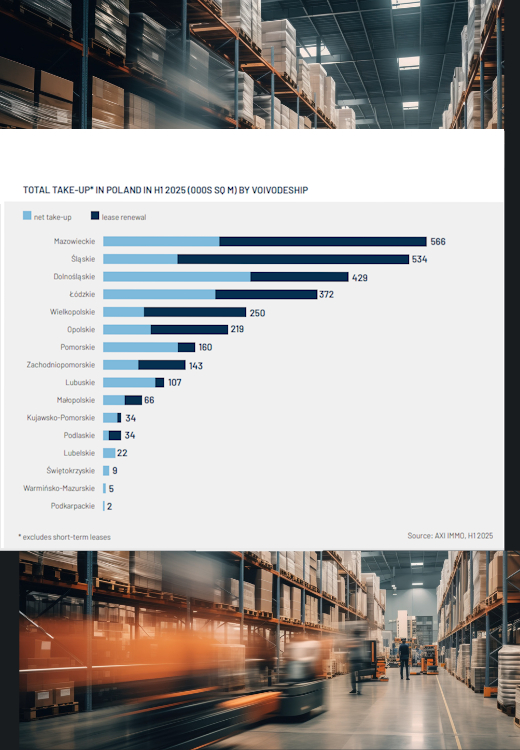

In the first half of 2025, gross demand for warehouse space in Pomerania amounted to 160,000 sq m, placing the region in the middle of the country's main warehouse provinces.

Most transactions were new lease agreements and expansions, and the market displays a highly diverse tenant base—from 3PL operators (e.g., 7R Park Gdańsk III – 80,000 sq m), through retail and manufacturing companies, to e-commerce.

New warehouse supply delivered in Pomerania in H1 2025 amounted to 69,000 sq m—the region remains active, although investment activity has slowed compared to previous years, with a large share of new projects being pre-let deals. At the end of June, 172,000 sq m was under construction, with the largest projects being 7R Park Gdańsk III and Panattoni Park Tricity South II.

At the end of June 2025, the vacancy rate in Pomerania stood at 10.7%, an increase of 3.6 percentage points year-on-year and the highest level of availability among the developed regions in Poland. This is a result of new, partially speculative investments being brought to market and the release of space by 3PL tenants over recent quarters—the last time such a high level of availability was recorded in the region was in 2015. Quoted rents for new big-box space range from €4.20 to €5.25/sq m/month. The stability of base and effective rents facilitates negotiations and encourages long-term contracts.

The key tenant groups in the region are logistics operators, retail chains, e-commerce, as well as manufacturing and distribution companies. The major deals in Pomerania included investments and leases in parks in Gdańsk and Gdynia. The high level of space availability encourages last-mile investments and flexible relocations. Pomerania is a market where an increasing number of transactions relate to contract extensions and renegotiations, reflecting a nationwide trend.

The above data comes from the AXI IMMO report 'Warehouse Market in Poland H1 2025'.

Contact

Katarzyna Głodowska

Senior Advisor Industrial & Logistics