AXI IMMO / Warehouses / Śląskie / Bielsko-Biała /

Panattoni Park Bielsko-Biała IV – warehouses for lease

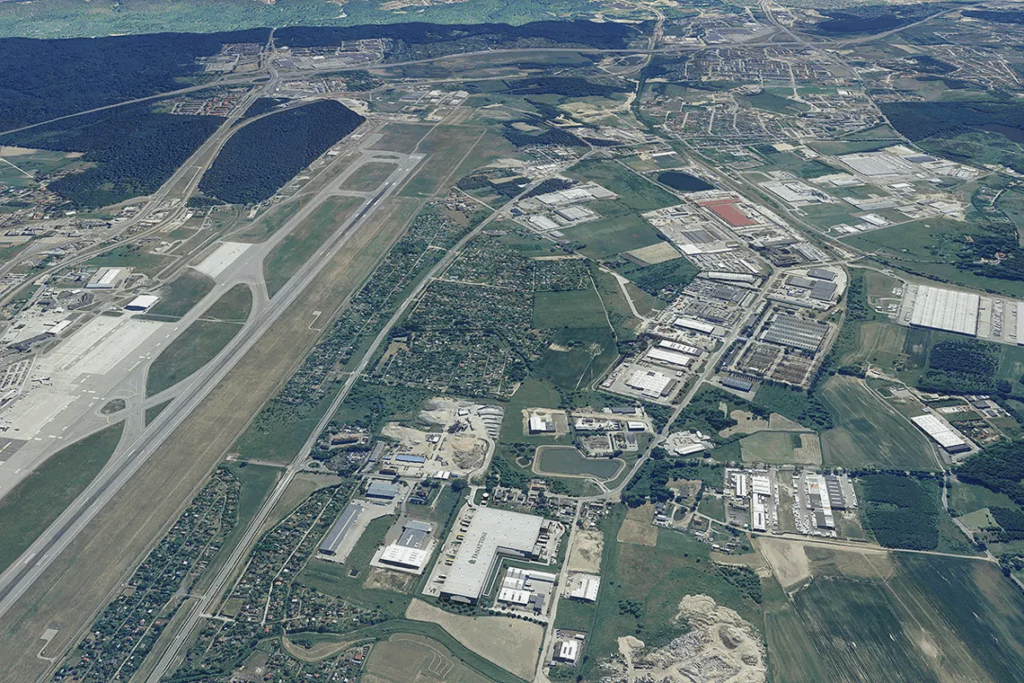

Warehouses and halls for lease in Bielsko-Biała at S52

The Panattoni Park Bielsko-Biała IV is a modern warehouse park of the developer Panattoni Europe. This is the 4th park of this developer in Bielsko-Biala.

Warehouses and halls in Bielsko-Biala, within the framework of the IV Panattoni Park in this location, can be used as storage space and as a production hall.

A logistically attractive location is one of the advantages of this new commercial property (on the S52 Katowice-Cieszyn expressway). The location close to Kraków and the Silesian Agglomeration gives the possibility of rapid distribution of goods in the Polish.

In addition, the proximity of the border and convenient road connection to the Czech Republic and Slovakia allows logistical service of these markets and further to the countries of Central Europe.

Tenants appreciate this location, as well as warehouses provided with Panattoni. This is confirmed by the fact that three previously built Panattoni parks in this area – Panattoni Park Bielsko-Biala I, Panattoni Park Bielsko-Biała II and Panattoni Park Bielsko-Biała III – with a total area of about 134 thousand sq.m. and are fully leased.

Panattoni Park Bielsko-Biała IV is a complex of 3 A-class buildings

Warehouse for lease

Warehouses intended for warehousing and light production

The warehouse part is a modern high storage area – 10 m height

Halls with loading docks and ‘0’ level gates

Floor loading capacity: 5T / sqm

Warehouse space lit by daylight through skylights

LED lighting used, which in turn translates into energy savings

Modern sprinkler system and smoke dampers

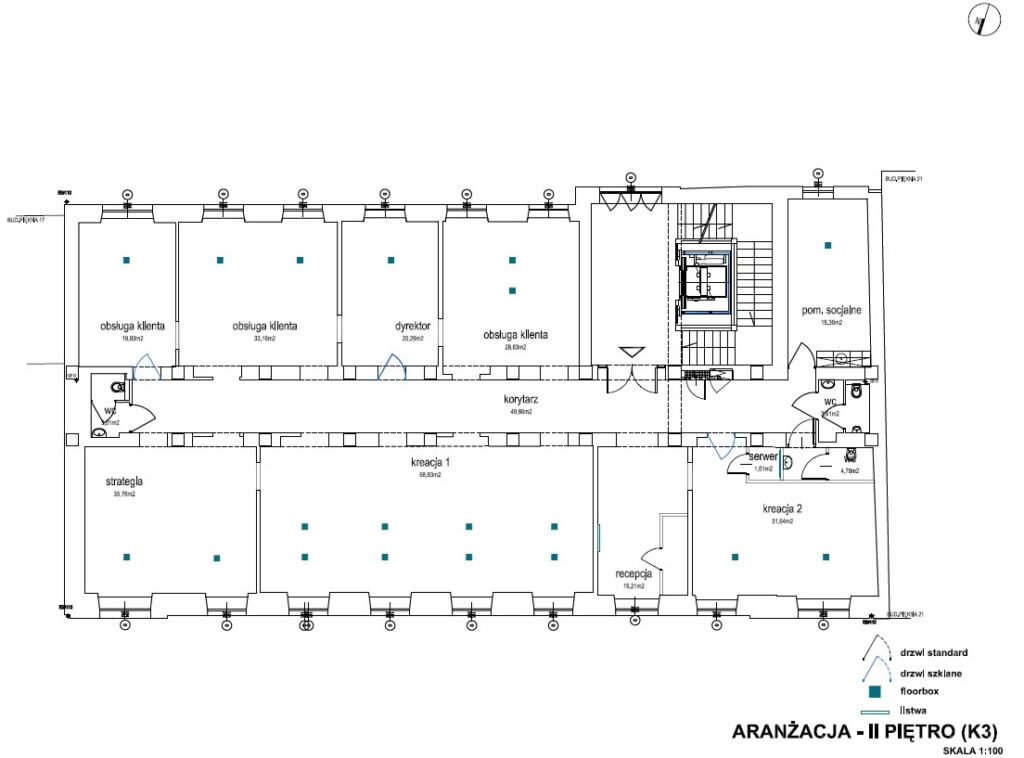

Office modules freely modified according to the client’s needs

Monitoring

24/7 real estate security

Maneuvering areas

Parking lots for trucks

Slip road

The project is certified in the BREEAM system at the ‘Very Good’ level

Each of the 3 buildings will be completed in 2021.

Location

A new warehouse park in southern Poland, on the border of the Śląskie and Małopolskie provinces, in Bielsko-Biała; Warehouses and halls at S52 – a route enabling easy access to Katowice and the entire Silesian Agglomeration, and on the other hand to Cieszyn; Good access to Krakow; Halls in the immediate vicinity of the S1 expressway, which will ultimately connect the Polish A1 motorway with the Slovak D3 motorway (in Zwardoń); Bielsko-Biała and its surroundings have enormous business potential; Automotive and IT companies have located their warehouses and production halls in the area. The textile, metallurgical and food industries are also well developed; The area of the city of Bielsko-Biała and its surroundings create ideal conditions for distribution and trade to the Central European market due to its location at the intersection of international communication routes connecting Poland, the Czech Republic and Slovakia: S1 to Zwardoń, where it will connect with the Slovak D3 motorway under construction; DK1 (part of E75 and E462) leads through Czechowice-Dziedzice to the Upper Silesian conurbation; S52 (part of E75 and E462) to Cieszyn and the Czech Republic; DK52 from Bielsko-Biała to Głogoczów near Krakow (connection with DK7 – Zakopianka).

Technical data

- Number of buildings3

- Possibility of productionYES

- CertificateNO

- Storage height (m)-

- Floor load capacity6

- Column grid12m x 22.5m

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance>4000

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)-

- Minimal space (sq m)-

- Roof SkylightsYES

- SprinklersYES

- MonitoringYES

- SecurityNO

- Offer IDmp11565

Developer

Panattoni Europe is an industrial space developer, active in the Polish market from 2005. Since then the company has developed projects totalling in excess of 5.7 million square metres. Panattoni Europe supports local business by delivering multi-purpose warehouse and production buildings with social and office premises, situated all over the country. Moreover, the developer specialises in build-to-suit (BTS) projects – tailored to the needs of an individual client.

Distances

Market data

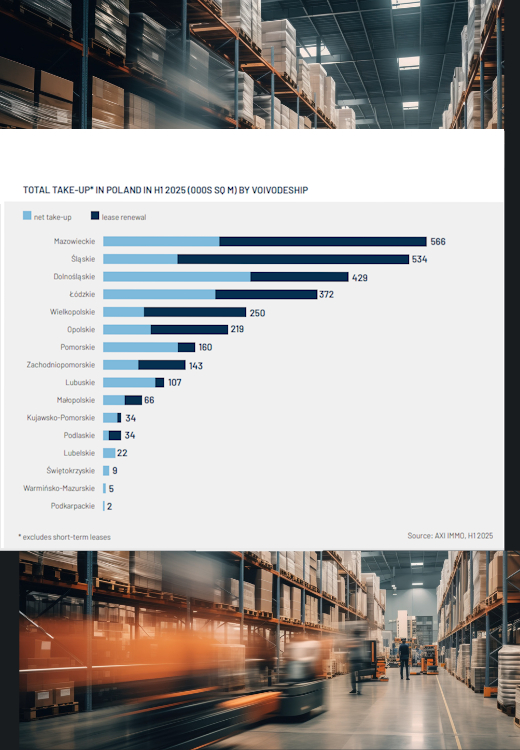

The Silesian voivodeship, with Katowice as its main centre, maintains its status as one of the largest and most liquid warehouse markets in the country.

By combining extensive road infrastructure with a vast stock of modern space, the region remains a key point on the Central European distribution map, serving both international and domestic logistics operators, retail chains, and manufacturing companies.

In the first half of 2025, gross demand for warehouse space in Silesia amounted to 534,000 sq m (2nd place in Poland), of which as much as 76% consisted of extensions of existing lease agreements—confirming the maturity of the market and the process of renegotiation among tenants with long-term contracts. Net demand—new contracts and expansions—was significant despite the overall downward trend in the country.

In H1 2025, developers delivered 256,000 sq m of modern warehouse space in Upper Silesia (2nd place nationwide). As of the end of June 2025, around 200,000 sq m remained under construction, with flagship projects including Panattoni Park Sosnowiec Expo (62,100 sq m), BOOSTER ZABRZE by LemonTree (41,000 sq m), and EQT Exeter Gliwice (36,100 sq m). Despite a decrease in speculative investments, Upper Silesia retains a high level of new developments, thanks to the strength of its local tenant base.

The vacancy rate at the end of June 2025 stands below the national average, at 7.0%, confirming strong space absorption and a stable tenancy structure. Asking rents in new big-box developments in the region range from €4.30 to €4.60/sq m/month, while older projects can be rented for around €4.00/sq m/month. For larger transactions, tenants can expect package deals and attractive effective conditions.

The main tenant groups in the region are manufacturing companies, e-commerce, retail chains, logistics operators, and entities from the distribution and FMCG sectors. The high proportion of lease renegotiations and the presence of global investors and operators confirm the maturity and long-term appeal of Upper Silesia for industrial and logistics business.

The above data comes from the AXI IMMO report 'Warehouse Market in Poland H1 2025'.

Contact

Anna Cholewa

Industrial & Logistics

Contact

Barbara Staśkiewicz-Wieczorek

Industrial & Logistics