AXI IMMO / Warehouses / Poznań / Swarzędz /

Warehouses to let in Swarzędz r. Poznań in the Swarzędz Logistic Center CLIP Poznań, Poland

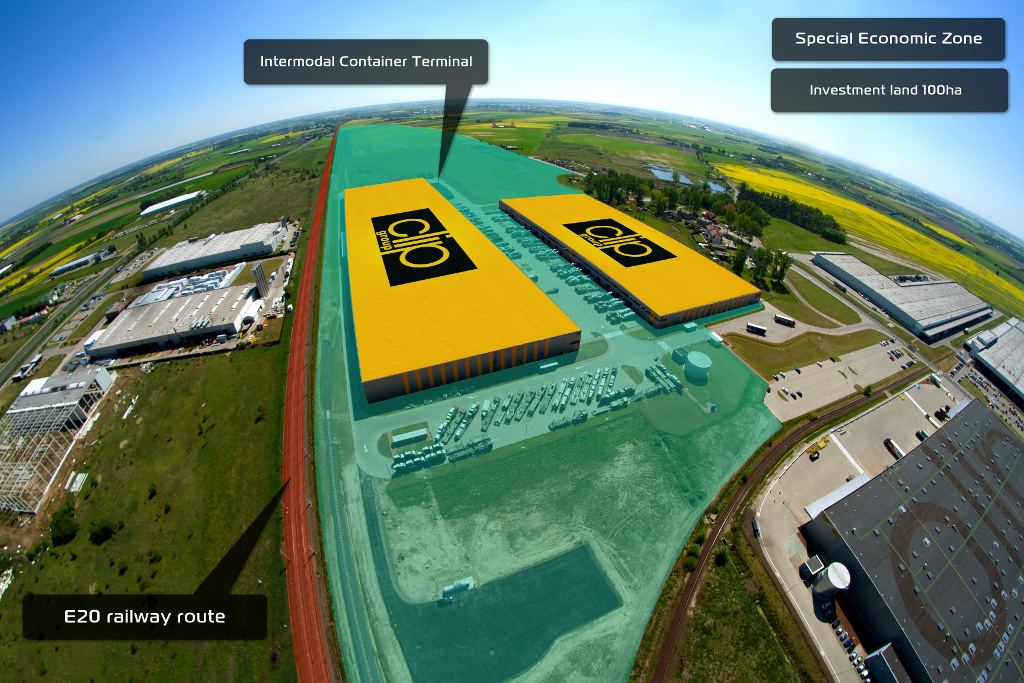

Waterhouse space to lease near Poznan in a special economic zone.

Swarzędz Logistic Center CLIP comprises high standard warehouse spaces to let situated near Poznań, in a special economic zone.

Modern warehouses to let Poznan region in Swarzędz city

A class warehouse space

Profile: warehousing, services and production

Parking spaces for cars and trucks

High-storage warehouse clear height from 10.5 meters to 13 meters

ESFR sprinkler system

Floor loading in the warehouse: 5 t/sq m

Loading ramps

Gas heating

The warehouse space can be arranged and modified according to clients’ needs

Access to the railway siding.

Location

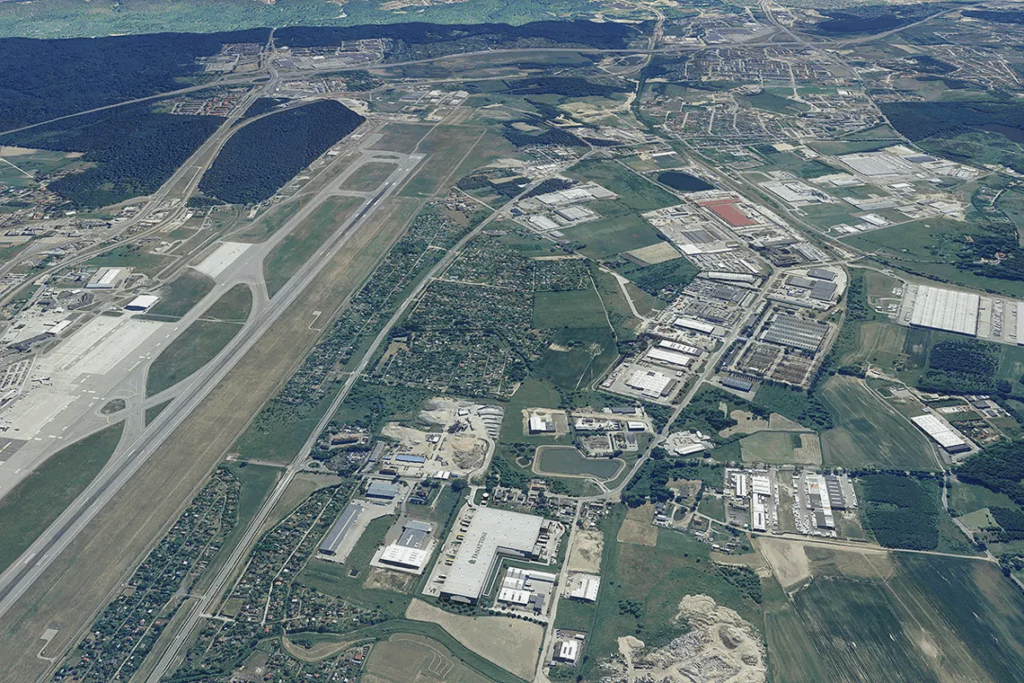

Swarzedz is a city in the metropolitan area of Poznan, in Western Poland; Warehouse park is situated in a special economic zone; In the proximity of the road no. 92; 3 km to junctions of the E30, the S11 and the A2 roads.

Technical data

- Number of buildings10

- Possibility of productionYES

- CertificateNO

- Storage height (m)12.5

- Floor load capacity5

- Column grid12x22,5

- Railway sidingYES

- Fire resistance4000

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Minimal space (sq m)-

- Roof SkylightsNO

- SprinklersNO

- MonitoringNO

- SecurityNO

- Offer IDmp10218

Distances

Market data

The Wielkopolskie voivodeship, with Poznań as its main centre, has for years remained one of the most important warehouse and logistics markets in Poland. It is one of the oldest logistic regions, formed along the 92 National Road and the A2 Highway now. This route enables the distribution of goods from East to West Europe towards Berlin.

Thanks to its strategic location on transit routes, proximity to the western border, and well-developed infrastructure, the Wielkopolska region is chosen by domestic and international logistics operators, retail chains, and manufacturers.

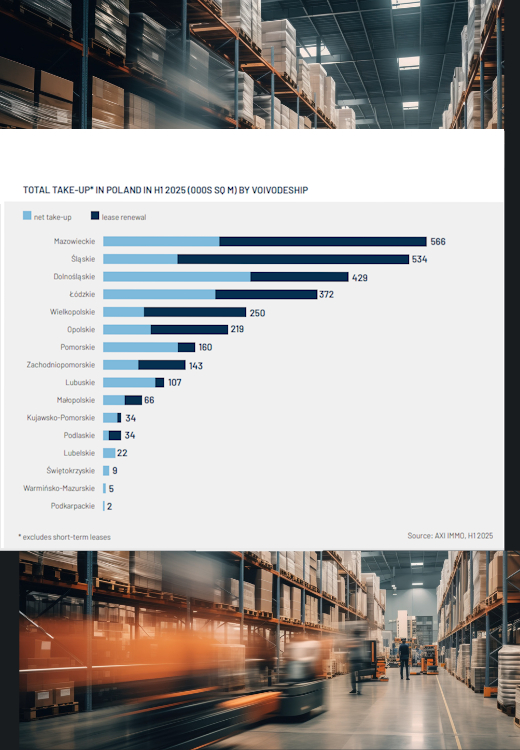

In the first half of 2025, gross demand in the region reached 250,000 sq m, placing Wielkopolska fifth among Polish provinces. Net demand—meaning new leases and expansions—stood at around 131,000 sq m, with a stable tenant structure from the retail, logistics, e-commerce, and manufacturing sectors.

New warehouse supply in Wielkopolska in the first half of 2025 amounted to 70,000 sq m, confirming developers’ cautious approach to new projects. A further 41,000 sq m was under construction at the end of June 2025, with the dominant form of investment being both large big-box logistics parks as well as BTS (build-to-suit) and last mile projects serving Poznań and the surrounding areas.

A stable vacancy rate confirms the market’s maturity and liquidity—at the end of H1 2025, the rate remained consistently at 6.6%. Average base rental rates for big-box logistics space in Wielkopolska range from €3.80 to €4.70/sq m/month, while in the best Poznań locations they can reach up to €5.20/sq m/month. The gap between rates in new and older projects is widening, and landlords are offering incentives for larger contracts or in locations with greater availability.

Wielkopolska attracts tenants from the retail and logistics sectors, e-commerce networks, courier operators, manufacturing firms, and FMCG distribution centres. In the first half of the year, the most important deals concerned large transactions in Poznań and its surroundings, including the lease of space at Hillwood Poznań-Czempiń Park (53,700 sq m).

The market provides a diverse range of modern warehouses, as well as opportunities for expansion, relocation, and operational consolidation.

The above data is sourced from the AXI IMMO report 'Warehouse Market in Poland H1 2025'.

Contact

Piotr Roszkowski

Associate Director Industrial & Logistics