AXI IMMO / Warehouses / Śląskie / Tychy /

Segro Industrial Park Tychy II

Warehouse in Special Economic Zone Katowice, Subzone Tychy

Warehouse space in Tychy

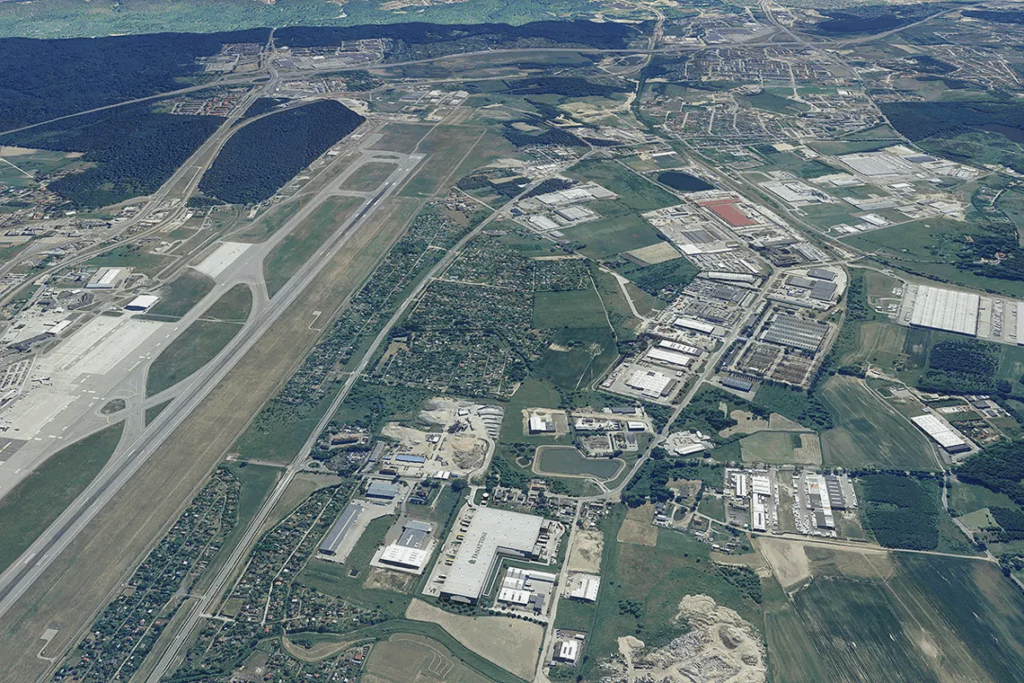

The SEGRO Industrial Park Tychy II logistics complex is modern warehouse space in Tychy, located in the eastern part of the city. The property is characterized by an excellent location in terms of access to the most important transport routes in the region, including: DK 44 (connection to the city center and communication on the Tychy-Mikołów-Gliwice route), DK86 (access to Katowice), route S1 (access to Bielsko -Biała), A4 motorway (Kraków-Wrocław route). In close proximity to the park covering warehouse space in Tychy, many companies from the automotive industry locate their plants.

A logistics park built to suit

As part of the second logistics park in Tychy, the SEGRO developer will provide over 40,000 square meters of modern warehouse and production space in two buildings. These facilities meet the highest standards of class A industrial halls, and office and social spaces have been designed and built in accordance with the requirements of clients. The area of the park is fenced, while the entrance is monitored 24/7 by security. Tenants of warehouse space in Tychy have access to parking spaces for cars and trucks as well as maneuvering areas. The minimum storage module for rent offered by the developer has an area of approximately 1,500 square meters.

Full site amenities including 24 h security

Convenient parking space

Truck court

ESFR sprinkler system

Skylights

Smoke vents

Drive in-doors

Loading docks with electrically operated dock levellers

Clear height: 10 m

Floor loading: 5 t/sq m

Skylights

Location

Warehouse in Special Economic Zone Katowice, Subzone Tychy Easy access to developed road and motorway infrastructure; Close to A4 motorway; Possibility to acquire qualified staff; Great conditions for distribution and logistics operations

Technical data

- Number of buildings2

- Possibility of productionYES

- CertificateNO

- Storage height (m)10

- Floor load capacity5

- Column grid12 x 22.5

- Railway sidingNO

- Fire resistance-

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Minimal space (sq m)-

- Roof SkylightsYES

- SprinklersYES

- MonitoringYES

- SecurityNO

- Offer IDmp10141

Developer

SEGRO is an English development company established in 1920, that permanently expands its business in continental Europe and in the UK. SEGRO brings together modern warehouses and light-production buildings, both in big-box and small business unit projects. The developer works with the world's leading companies of different branches in Warsaw, Poznan, Central Poland and Silesia.

Distances

Market data

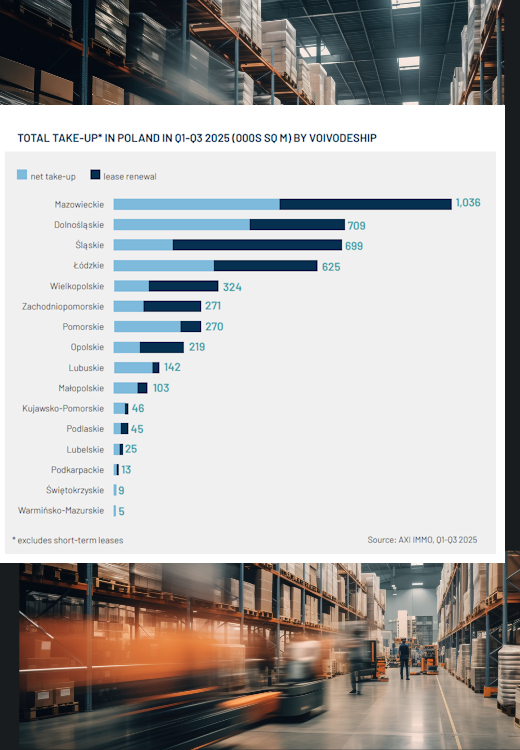

The Silesian Voivodeship, with its main centre in Katowice, remains one of the largest and most liquid warehouse markets in Poland.

The Silesian Voivodeship region, combining extensive road infrastructure and many modern spaces, remains a key point on the distribution map of Central Europe, serving both international and domestic logistics operators, retail chains and manufacturing companies.

Demand for warehouses is invariably increasing

At the end of the third quarter of 2025, gross demand for warehouse space in the Silesian Voivodeship amounted to 699 thousand m² (3rd place in Poland). Net demand, i.e. new contracts and expansions, was significant despite the general downward trend in Poland.

New warehouses and large-scale halls in Silesia

In the period from Q1 to Q3 2025, developers commissioned 275 thousand m² of modern warehouse space in Upper Silesia (2nd place in Poland). The flagship projects include, m.in, Panattoni Park Sosnowiec Expo (62,100 m²), BOOSTER ZABRZE by LemonTree (41,000 m²) and EQT Exeter Gliwice (36,100 m²). Despite the decline in speculative investment, Upper Silesia maintains a high level of new development thanks to the strength of its local tenant base.

Logistics and production space available immediately

The vacancy rate in the Silesian Voivodeship at the end of September 2025 remains below the national average of 8.2%, confirming the deep absorption of space and the stable lease structure of modern industrial and logistics space.

What are the rent rates for renting warehouses in Upper Silesia?

Offer rents for new big-box investments in the region range from EUR 3.70 to EUR 5.00/m²/month. For larger transactions, tenants can expect package offers and attractive, effective conditions.

For whom is Silesia an attractive location for warehousing?

The most important groups of tenants in the region are manufacturing companies, e-commerce, retail chains, logistics operators, and entities from the distribution and FMCG industries. A clear share of lease renegotiations and the presence of investors and global operators confirm the maturity and long-term attractiveness of Upper Silesia for industrial and logistics business.

Source: The above data comes from the AXI IMMO report 'Warehouse Market in Poland Q3 2025'.

Contact

Anna Głowacz

Head of Industrial - Leasing Agency

Contact

Anna Cholewa

Industrial & Logistics