AXI IMMO / Warehouses / Śląskie / Gliwice /

Segro Business Park Gliwice

Warehouse and office space for rent in the A-class park of Segro Business Park Gliwice

High storage warehouses in Gliwice

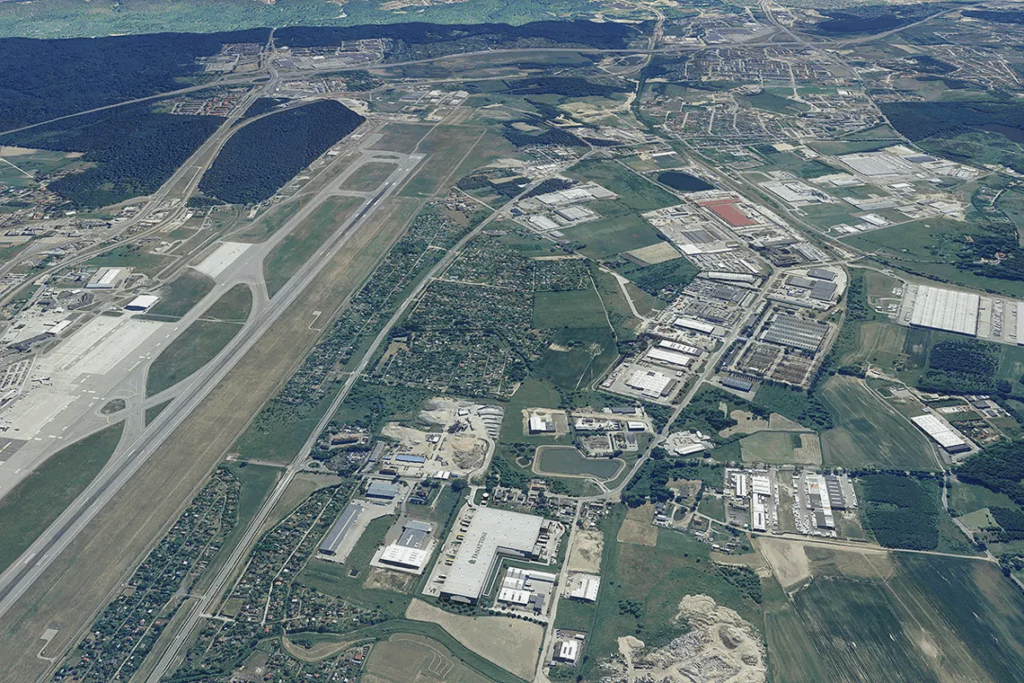

SEGRO Business Park Gliwice is an industrial facility comprising two high storage warehouses in Gliwice, totalling 24,800 sq m. The property lies near national road no. 88, which ensures connections with A1 and A4 motorways, Drogowa Trasa Średnicowa and the city center. Tenants of the high storage warehouses in Gliwice can benefit from significant tax exemptions due to the complex’s location within Katowice Special Economic Zone. The zone is a substantial employment area with wide range of both international and national companies involved in storage and manufacturing.

Flexible warehouse and production space

The high storage warehouses in Gliwice offer flexible industrial space that can be easily adapted for production. Initially the buildings were designed as standard A-class halls and their technical specification may be modified according to the client’s requirements. The warehouses can accommodate high storage racks due to their clear internal height (10 m) and floor capacity (5 t/sq m). Loading docks and drive-in gates ensure smooth flow of goods within the facility, which is also fitted with heating installation, sprinkler system and smoke vents. External areas include truck yards, ample parking spaces and green areas.

Offices at warehouse level

Clear height: 10 m

Floor loading: 10 t/sq m

Loading docks

Gates in on level ‘0’

Skylights

Park fenced

Parking space

Truck courts

A-class buildings

Office space can be arranged according to the needs of tenants

Location

Warehouse park Segro Business Park Gliwice located in southern Poland, 35 km from Katowice city; Segro Business Park Gliwice is located in areas belonging to the Special Economic Zone; 1km from A4 motorway; 6 km from planned crossroads of A4 and A1 motorways; Possibility to access qualified staff; Great logistics and distribution conditions

Technical data

- Number of buildings4

- Possibility of productionYES

- CertificateNO

- Storage height (m)10

- Floor load capacity5

- Column grid12m x 22.5m

- Railway sidingNO

- Fire resistance-

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Minimal space (sq m)-

- Roof SkylightsYES

- SprinklersYES

- MonitoringYES

- SecurityNO

- Offer IDmp10731

Developer

SEGRO is a leading owner, manager and developer of modern warehouses and light industrial property. It owns or manages over six million square metres of space valued at £8 billion serving customers from a wide range of industry sectors. SEGRO's parks are located in and around major cities and at key transportation hubs in the UK and in nine other European countries. In Poland, the developer offers properties for rent in: Gdansk, Gliwice, Lodz, Poznan, Prague, Strykow, Tychy, Warsaw and Wroclaw.

Distances

Market data

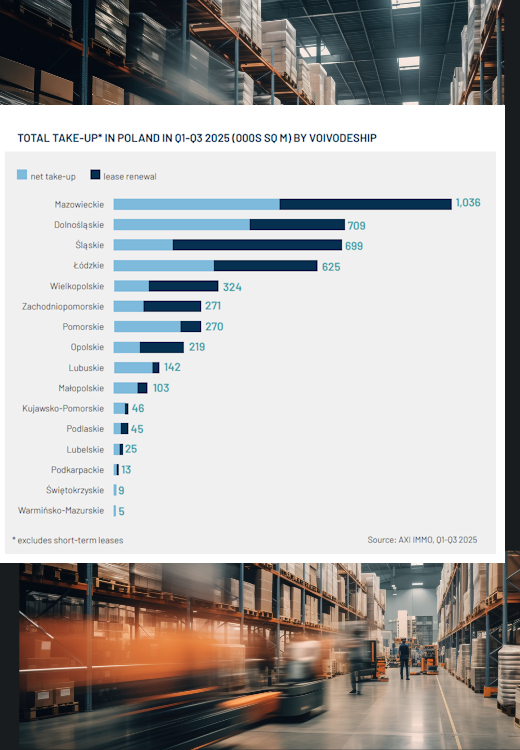

The Silesian Voivodeship, with its main centre in Katowice, remains one of the largest and most liquid warehouse markets in Poland.

The Silesian Voivodeship region, combining extensive road infrastructure and many modern spaces, remains a key point on the distribution map of Central Europe, serving both international and domestic logistics operators, retail chains and manufacturing companies.

Demand for warehouses is invariably increasing

At the end of the third quarter of 2025, gross demand for warehouse space in the Silesian Voivodeship amounted to 699 thousand m² (3rd place in Poland). Net demand, i.e. new contracts and expansions, was significant despite the general downward trend in Poland.

New warehouses and large-scale halls in Silesia

In the period from Q1 to Q3 2025, developers commissioned 275 thousand m² of modern warehouse space in Upper Silesia (2nd place in Poland). The flagship projects include, m.in, Panattoni Park Sosnowiec Expo (62,100 m²), BOOSTER ZABRZE by LemonTree (41,000 m²) and EQT Exeter Gliwice (36,100 m²). Despite the decline in speculative investment, Upper Silesia maintains a high level of new development thanks to the strength of its local tenant base.

Logistics and production space available immediately

The vacancy rate in the Silesian Voivodeship at the end of September 2025 remains below the national average of 8.2%, confirming the deep absorption of space and the stable lease structure of modern industrial and logistics space.

What are the rent rates for renting warehouses in Upper Silesia?

Offer rents for new big-box investments in the region range from EUR 3.70 to EUR 5.00/m²/month. For larger transactions, tenants can expect package offers and attractive, effective conditions.

For whom is Silesia an attractive location for warehousing?

The most important groups of tenants in the region are manufacturing companies, e-commerce, retail chains, logistics operators, and entities from the distribution and FMCG industries. A clear share of lease renegotiations and the presence of investors and global operators confirm the maturity and long-term attractiveness of Upper Silesia for industrial and logistics business.

Source: The above data comes from the AXI IMMO report 'Warehouse Market in Poland Q3 2025'.

Contact

Anna Głowacz

Head of Industrial - Leasing Agency

Contact

Anna Cholewa

Industrial & Logistics