AXI IMMO / Warehouses / Śląskie / Bytom /

A modern logistics park in Bytom with the possibility of renting up to 65,000 sq m of industrial space

Warehouse for rent Bytom, southern Poland

The planned logistics park in Bytom is a modern warehouse and office complex, consisting of two buildings with a total area of over 65,000 m².

The logistics park offers extensive infrastructure, including numerous parking spaces for cars and trucks, maneuvering zones and loading and unloading areas. The location of the investment in Bytom provides convenient transport connections with the main road routes of the region, which makes it an attractive point for companies looking for efficient logistics and quick access to the market.

The investment is part of the region’s economic development strategy, contributing to increasing the attractiveness of the local labor market and attracting new investors.

High standard A+, Access via docks and gates from level 0, large parking lot, maneuvering areas, 24/7 monitoring and security, dust-free floor, Office and social facilities, Breeam Certification

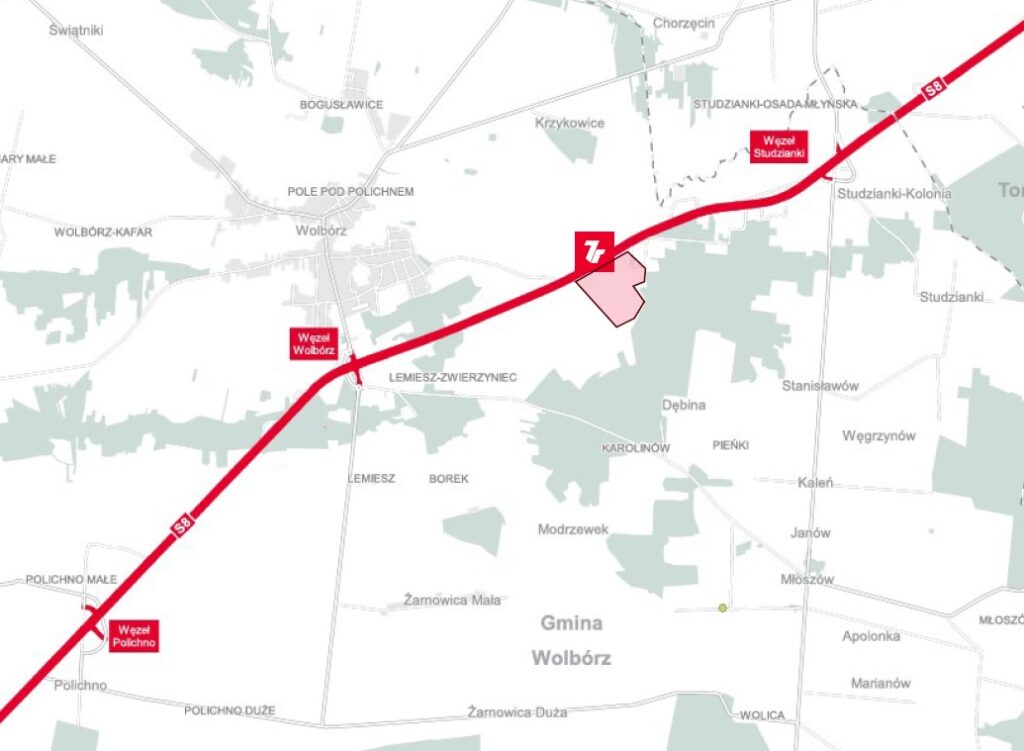

Location

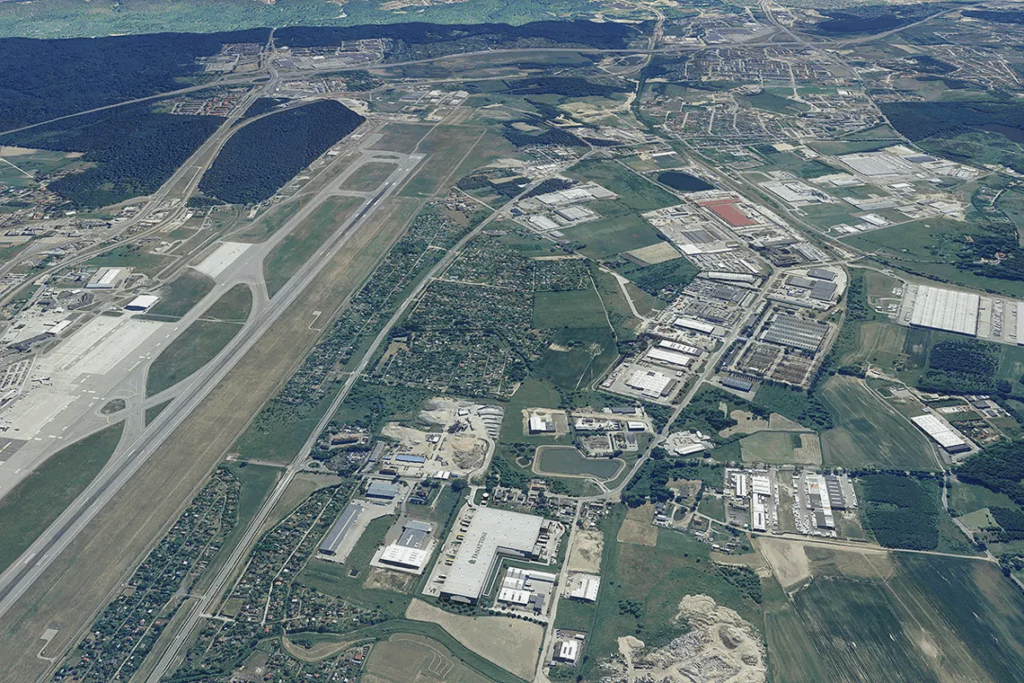

The location of the offered property in Bytom is characterized by an excellent connection to key motorways and expressways, such as A1, A4 and S1, which provides quick access to the entire region of Upper Silesia and beyond.Key Distances: A1 motorway (Bytom Junction) - 4 km A4 motorway (Kleszczów junction) - 14 km S1 expressway - 10 km National road DK88 - 5 km Katowice - 17 km Zabrze - 9 km Katowice-Pyrzowice Airport - 23 km

Technical data

- Number of buildings4

- Possibility of productionNO

- CertificateYES

- Storage height (m)-

- Floor load capacity-

- Column grid12 x 24

- Railway sidingNO

- Fire resistance>4000

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Minimal space (sq m)-

- Roof SkylightsNO

- SprinklersNO

- MonitoringNO

- SecurityNO

- Offer IDmp12424

Developer

X

Market data

The Silesian Voivodeship, with its main centre in Katowice, remains one of the largest and most liquid warehouse markets in Poland.

The Silesian Voivodeship region, combining extensive road infrastructure and many modern spaces, remains a key point on the distribution map of Central Europe, serving both international and domestic logistics operators, retail chains and manufacturing companies.

Demand for warehouses is invariably increasing

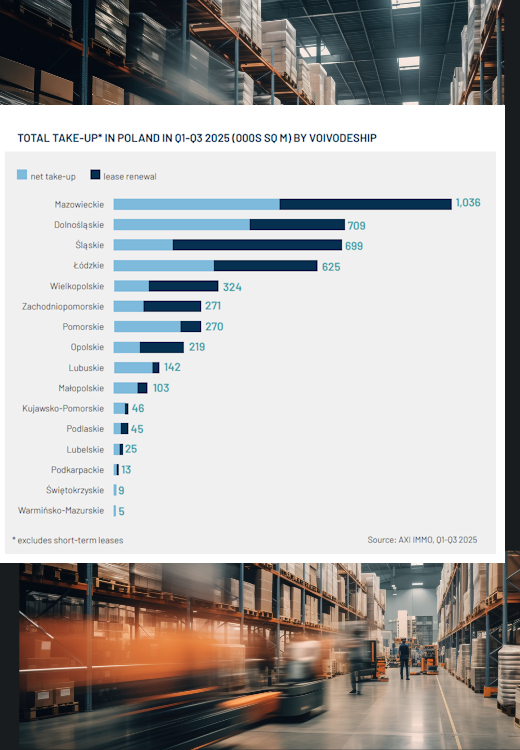

At the end of the third quarter of 2025, gross demand for warehouse space in the Silesian Voivodeship amounted to 699 thousand m² (3rd place in Poland). Net demand, i.e. new contracts and expansions, was significant despite the general downward trend in Poland.

New warehouses and large-scale halls in Silesia

In the period from Q1 to Q3 2025, developers commissioned 275 thousand m² of modern warehouse space in Upper Silesia (2nd place in Poland). The flagship projects include, m.in, Panattoni Park Sosnowiec Expo (62,100 m²), BOOSTER ZABRZE by LemonTree (41,000 m²) and EQT Exeter Gliwice (36,100 m²). Despite the decline in speculative investment, Upper Silesia maintains a high level of new development thanks to the strength of its local tenant base.

Logistics and production space available immediately

The vacancy rate in the Silesian Voivodeship at the end of September 2025 remains below the national average of 8.2%, confirming the deep absorption of space and the stable lease structure of modern industrial and logistics space.

What are the rent rates for renting warehouses in Upper Silesia?

Offer rents for new big-box investments in the region range from EUR 3.70 to EUR 5.00/m²/month. For larger transactions, tenants can expect package offers and attractive, effective conditions.

For whom is Silesia an attractive location for warehousing?

The most important groups of tenants in the region are manufacturing companies, e-commerce, retail chains, logistics operators, and entities from the distribution and FMCG industries. A clear share of lease renegotiations and the presence of investors and global operators confirm the maturity and long-term attractiveness of Upper Silesia for industrial and logistics business.

Source: The above data comes from the AXI IMMO report 'Warehouse Market in Poland Q3 2025'.

Contact

Anna Cholewa

Industrial & Logistics

Contact

Myroslava Muchychka

Industrial and Logistics