AXI IMMO / Warehouses / Rzeszów /

A modern warehouse for lease near the Polish-Ukrainian border

Warehouse for rent in south-eastern Poland

The distribution center Korczowa Logistic Park is ideal solution for companies developing in the eastern market. It is located near the Poland-Ukraine border in Korczowa, in the immediate vicinity of the border crossing Korczowa-Krakowiec. A4 motorway and national road no. 94 allow the distribution of goods from Rzeszów westward, along virtually the entire country – to Wroclaw and Dresden.

Logistic Park Korczowa provides one of the few A-Class space in the region of Podkarpacie voivodship, offering a complete space of more than 50,000 square meters in two phases. The solutions and flexible production and storage modules satisfy clients focused on logistics and distribution. In the Logistic Park Korczowa will be also set the point of customs clearance and TIR driver service together with a comprehensive package of services (restaurant, parking and maneuvering area).

Region of Rzeszów invites investors due to economic development and resource of qualified workforce.

The warehouse property is adapted to the handling of goods that require specialized equipment

Possibility of confectioning, repackaging and completing courier shipments directly to eastern markets

It is possible to arrange the space according to the customer’s requirements

10 m high

Docks and drive in gates

5 t floor loading

The location is part of the Poland Investment Zone program (formerly Special Economic Zones). This allows investors to benefit from corporate/personal income tax exemptions (CIT/PIT) for a period of 10–15 years, covering up to 70% of the planned investment value. We encourage you to contact us for more details.

Location

A modern warehouse park is located close to Rzeszów. Only 1.5 km from the border crossing with Ukraine. About 0.5 km from the A4 motorway junction – Korczowa junction. Directly on the international E40 route. This location allows investors to benefit from corporate/personal income tax exemptions (CIT/PIT).

Technical data

- Number of buildings3

- Possibility of productionNO

- CertificateNO

- Storage height (m)12

- Floor load capacity5

- Column grid12 x 24

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance4000

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)-

- Minimal space (sq m)1296

- Roof SkylightsYES

- SprinklersYES

- MonitoringYES

- SecurityNO

- Offer IDmp10228

Developer

The comapny has been implementing development projects throughout Poland since 2010. On the commercial real estate market as a developer specializing in the construction and rental of modern warehouse, production and office area.

Distances

Market data

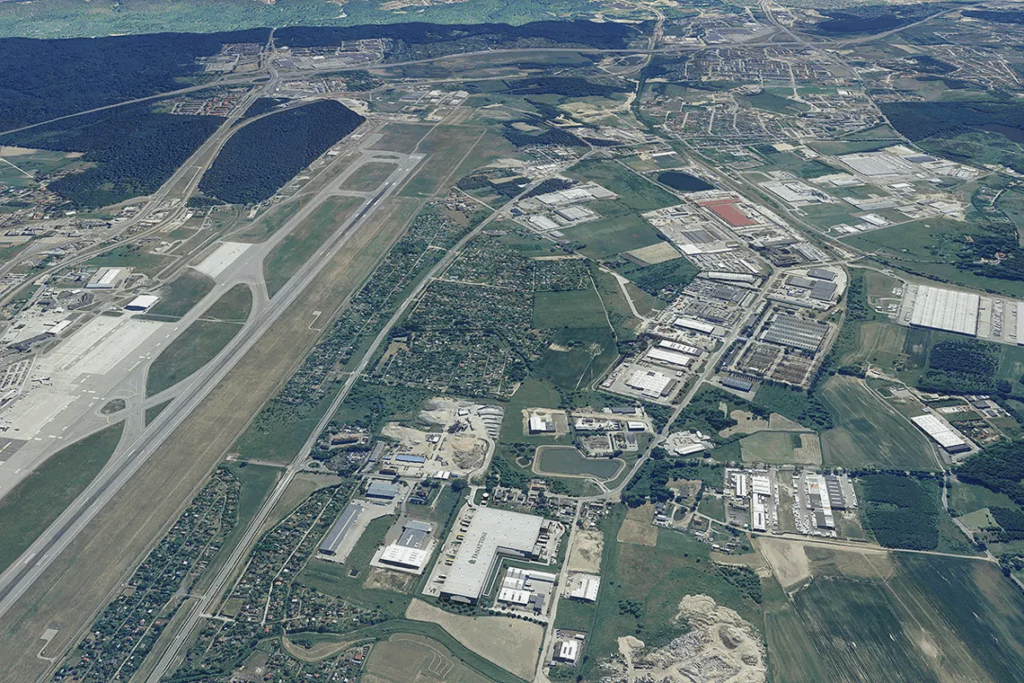

The warehouse market in Rzeszów as its main centre, is increasingly establishing itself as a logistics gateway for south-eastern Poland, with the highest concentration of modern warehouse space being built around the city and Rzeszów-Jasionka airport.

The region benefits from its proximity to the borders with Slovakia and Ukraine, as well as good access to the A4 motorway and the S19 expressway—factors conducive to investment in logistics and production.

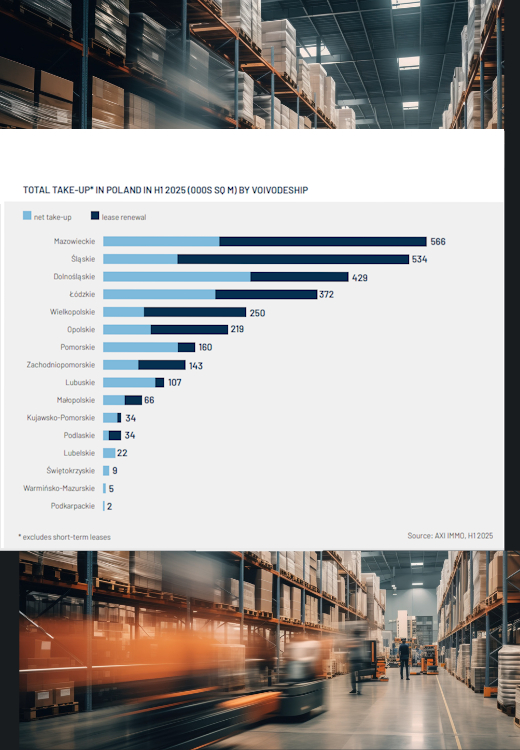

In the first half of 2025, new warehouse supply in Podkarpackie amounted to 33,000 sq m, placing the region mid-table among voivodeships in terms of developer activity. As at the end of June 2025, 39,000 sq m was under construction, including the Panattoni Park Rzeszów West project (73,300 sq m, with completion scheduled for the second half of the year).

Gross demand for the first half of 2025 was about 5,000 sq m (similar to Q1 2025), which remains very limited and is mainly driven by local distribution networks, production, and operators serving eastern external markets. Tenant activity is selective and based on current needs in the FMCG and manufacturing sectors and expanding e-commerce.

The vacancy rate in Podkarpackie remains close to zero, confirming high absorption of available space and that investments are exclusively build-to-contract or pre-let. This environment favours tenants seeking modern, high-specification BTS (build-to-suit) warehouses.

The main tenants remain production companies, national and local retail chains, and logistics operators serving southern and eastern markets (Ukraine, Slovakia). Demand is driven by the need for space for distribution, storage of FMCG goods, and handling so-called industrial and e-commerce logistics. Most new projects are constructed on a pre-let basis, while BTS investments are tailored to the requirements of specific tenants.

The above data comes from the AXI IMMO report ‘Warehouse Market in Poland H1 2025’.

Contact

Marta Nowik

Director Industrial & Logistics