AXI IMMO / Warehouses / Szczecin /

Cold storage warehouse in Szczecin

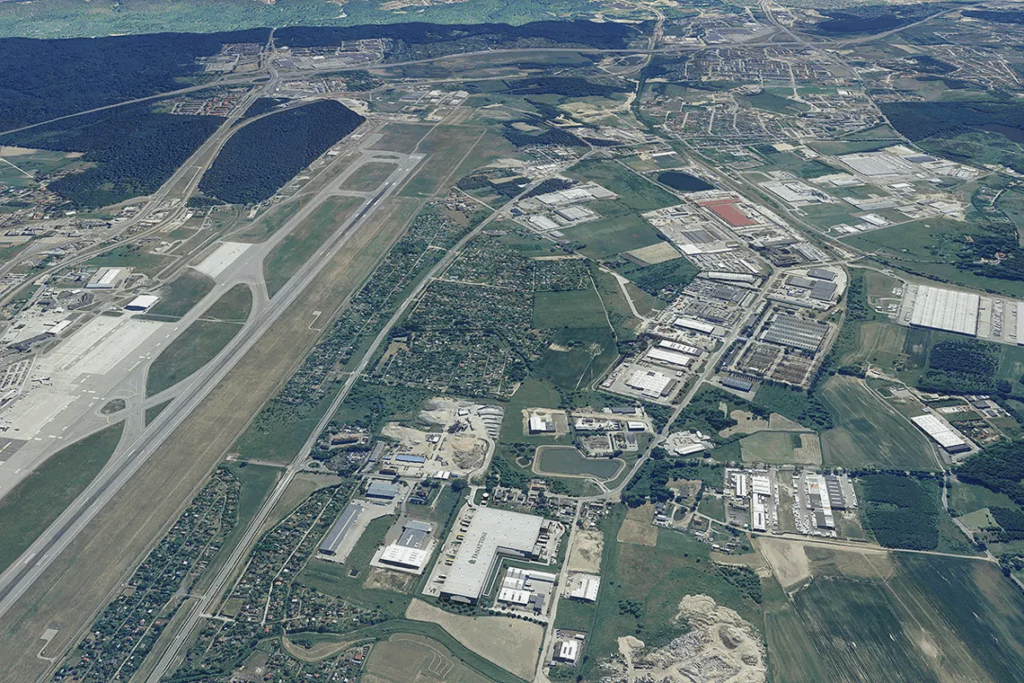

Temperature-controlled warehouse located in the eastern part of Szczecin

Temperature-controlled warehouses located in the eastern part of Szczecin, ideal for the food industry. The facility will be available for rent from April 1, 2025. It is equipped with freezing rooms, cold storage, dry warehouses, representative offices, and a large maneuvering area. The total property area is 3,284 sqm, and the plot area is 6,438 sqm.

Deep-freeze chambers of 577 sqm + 287 sqm [-23°C] Zero-degree cold storage of 320 sqm Positive pre-cooling rooms of 199 sqm + 58 sqm [+8°C] Dry warehouses of 1,606 sqm 3 loading ramps 3 ground-level doors Maneuvering area of 1,576 sqm Own transformer station Dust-free flooring Dry warehouse height: approx. 6.2 m

Location

The property is located in the eastern part of Szczecin, offering excellent access to the city center and the rest of the region. Close proximity to highways and the German border provides quick connections to other parts of Poland and Europe, including Scandinavia. Public transport stops and the SKM train station are nearby, ensuring convenient access for employees.

Technical data

- Number of buildings1

- Possibility of productionNO

- CertificateNO

- Storage height (m)6.2

- Floor load capacity-

- Column grid-

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance-

- DocksNO

- Ground level access doorsYES

- Cold store/freezerYES

- Office space (sq m)-

- Minimal space (sq m)3284

- Roof SkylightsNO

- SprinklersNO

- MonitoringYES

- SecurityNO

- Offer IDmm3354

Distances

Market data

The West Pomeranian Voivodeship, with Szczecin as its main hub, is one of the most important and fastest-growing warehouse markets due to its strategic location at the crossroads of routes to Germany and Scandinavia, as well as direct access to the Szczecin-Świnoujście port and Szczecin-Goleniów airport. The warehouse space on offer in Szczecin, Goleniów, Stargard, Kołbaskowo, Gryfino, and Nowogard includes modern halls and logistics centres with the highest standard of equipment, serving tenants from the logistics, manufacturing, and e-commerce sectors.

In the first half of 2025, there was 1.24 million m² of modern warehouse and production space available on the market, accounting for 3.6% of Poland's total warehouse stock. During this period, an impressive 102,000 m² of space was delivered – the fourth-highest result in Poland. A further 114,000 m² was under construction, and developers have secured another 800,000 m² for future investments. The West Pomeranian region is distinguished by the Panattoni Park Szczecin V project (49,700 m²), a BTS for Action (54,400 m²), and the LemonTree park (31,400 m²).

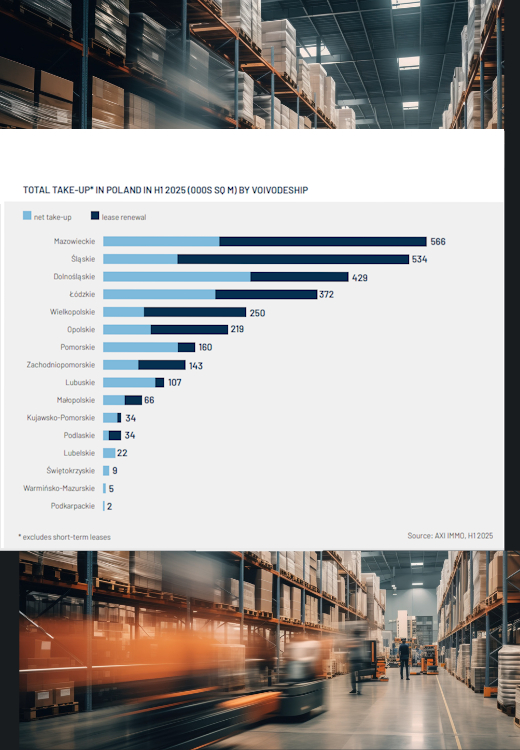

The logistics, manufacturing, and e-commerce sectors are the main drivers of regional demand. In the first half of 2025, 174,000 m² of logistics space was leased (gross take-up; a decrease of ~23% year-on-year), of which 66% consisted of new agreements and expansions (net take-up: 115,000 m²). The average transaction size was one of the highest in Poland at 10,200 m². The most significant lease agreements related to centres in Szczecin, Stargard, and Goleniów.

At the end of June 2025, the vacancy rate dropped to 2.8% – one of the lowest levels in the country, following a dynamic fall in space availability over the last 12 months. Asking rents in new projects and key locations remain stable at €4.10–€4.75/m²/month. The lowest rents can be found in Stargard, while the highest apply to new developments in Szczecin. Lease terms are similar to the national average, and landlords are offering fairly broad incentive packages for tenants signing large or long-term contracts.

The West Pomeranian Voivodeship attracts not only Polish but also foreign developers. Investment activity is concentrated on big-box, BTS, and warehouse projects that support rapid transhipment and international distribution. Developers such as Panattoni, LemonTree, EQT Exeter, and Mapletree are carrying out new investments, with plans for further expansion near key routes and ports.

The growth in regional activity is driven by the development of road infrastructure, access to a skilled workforce, and proximity to Western markets. The West Pomeranian region is a hub for companies serving both north-western Poland and Germany/Scandinavia.

Data comes from the Axi Immo Report - The Warehouse Market in Poland in H1 of 2025.

Contact

Anna Gawrońska

Industrial & Logistics