AXI IMMO / Warehouses / Szczecin /

Warehouse on Szczecin's Right Bank

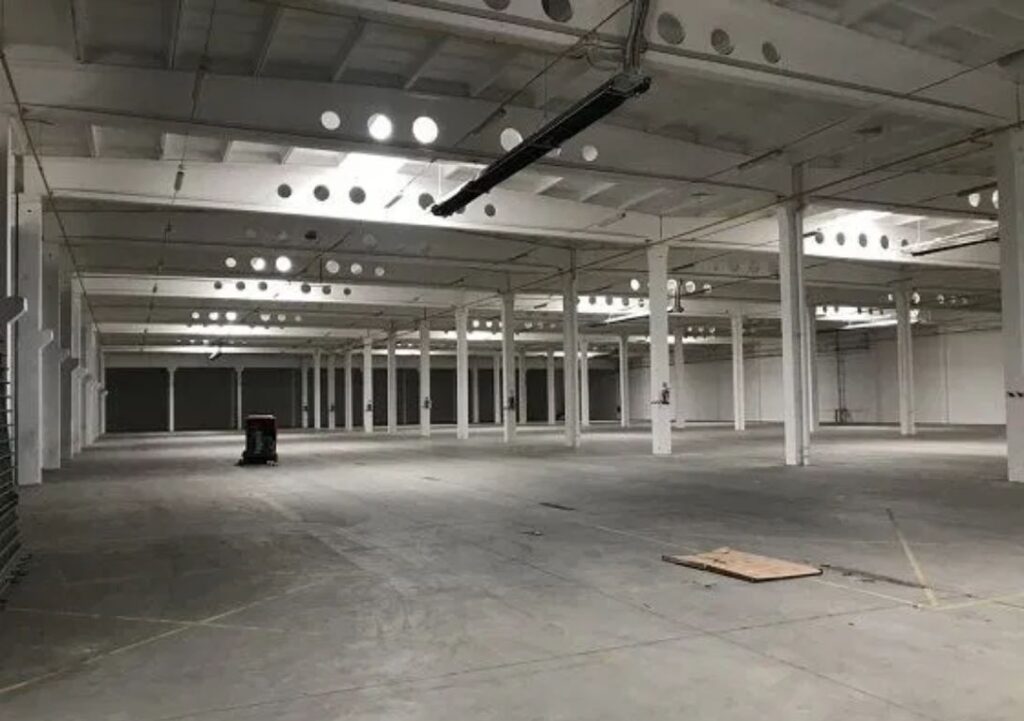

Warehouse for lease with an area of 9,000 sqm

The property is ideal for logistics, warehousing and manufacturing operations.

The hall has entrance gates from level 0, is heated and illuminated with skylights. The hall has office and social rooms. It is surrounded by a large maneuvering area. The area is secured and monitored.

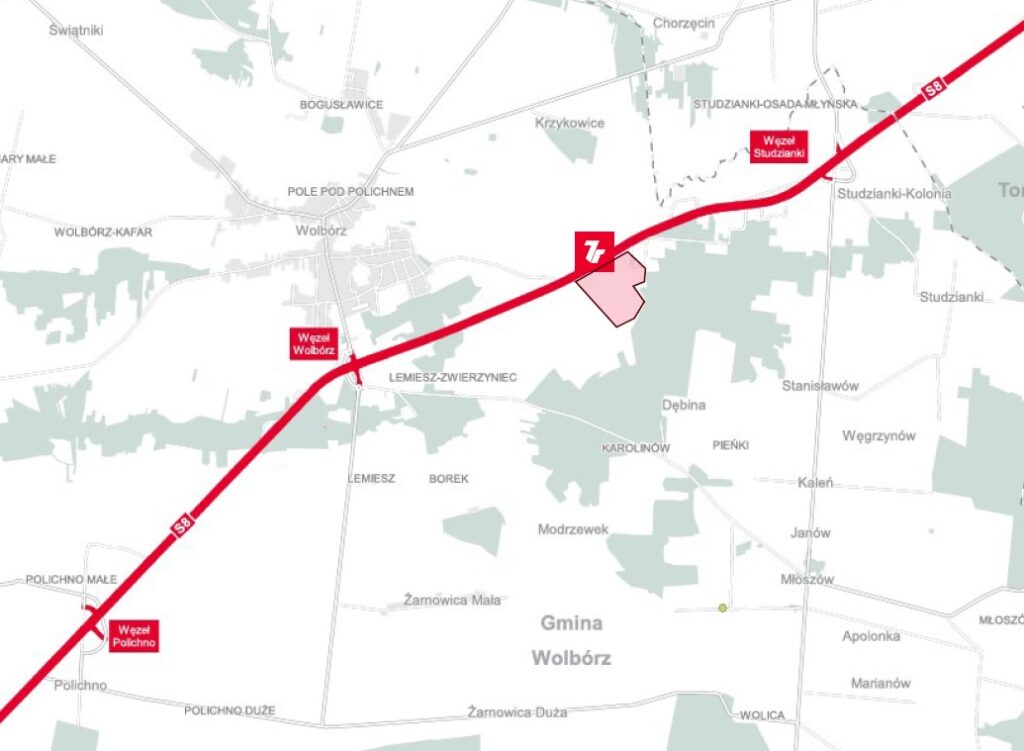

Location

The location allows for efficient exit from the city to the S3 road junction towards the border in Kołbaskowo and inland, as well as quick access to the Port of Szczecin.

Technical data

- Number of buildings1

- Possibility of productionYES

- CertificateNO

- Storage height (m)8.3

- Floor load capacity6

- Column grid6m x 18m

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance4000

- DocksNO

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)-

- Minimal space (sq m)-

- Roof SkylightsYES

- SprinklersNO

- MonitoringYES

- SecurityNO

- Offer IDmp12293

Developer

Private investor

Distances

Market data

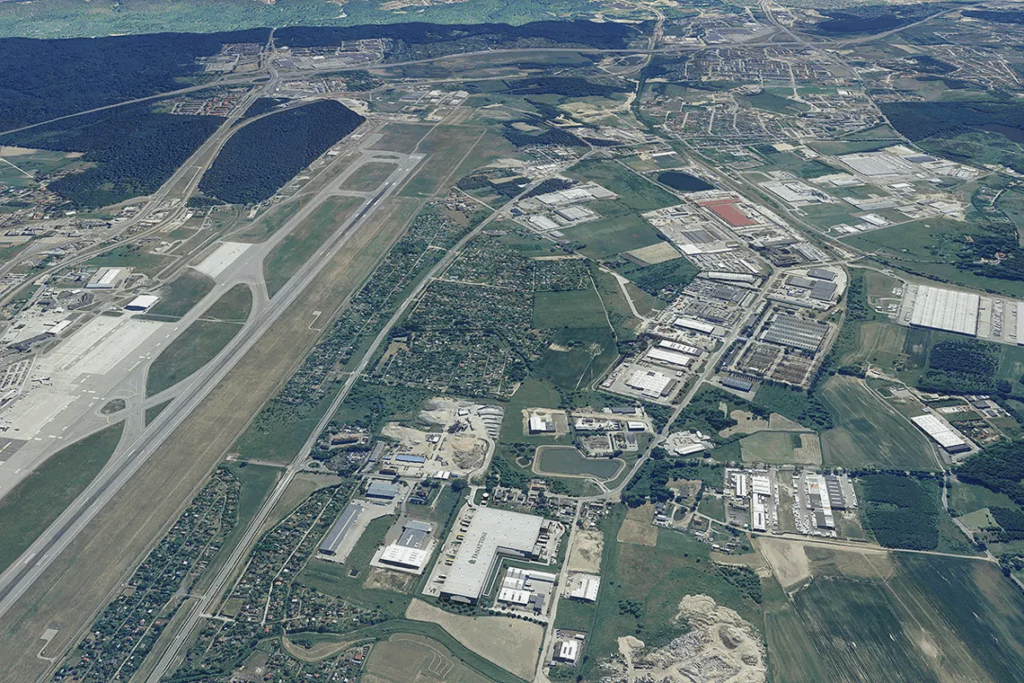

The West Pomeranian Voivodeship, with Szczecin as its main hub, is one of the most important and fastest-growing warehouse markets due to its strategic location at the crossroads of routes to Germany and Scandinavia, as well as direct access to the Szczecin-Świnoujście port and Szczecin-Goleniów airport. The warehouse space on offer in Szczecin, Goleniów, Stargard, Kołbaskowo, Gryfino, and Nowogard includes modern halls and logistics centres with the highest standard of equipment, serving tenants from the logistics, manufacturing, and e-commerce sectors.

In the first half of 2025, there was 1.24 million m² of modern warehouse and production space available on the market, accounting for 3.6% of Poland's total warehouse stock. During this period, an impressive 102,000 m² of space was delivered – the fourth-highest result in Poland. A further 114,000 m² was under construction, and developers have secured another 800,000 m² for future investments. The West Pomeranian region is distinguished by the Panattoni Park Szczecin V project (49,700 m²), a BTS for Action (54,400 m²), and the LemonTree park (31,400 m²).

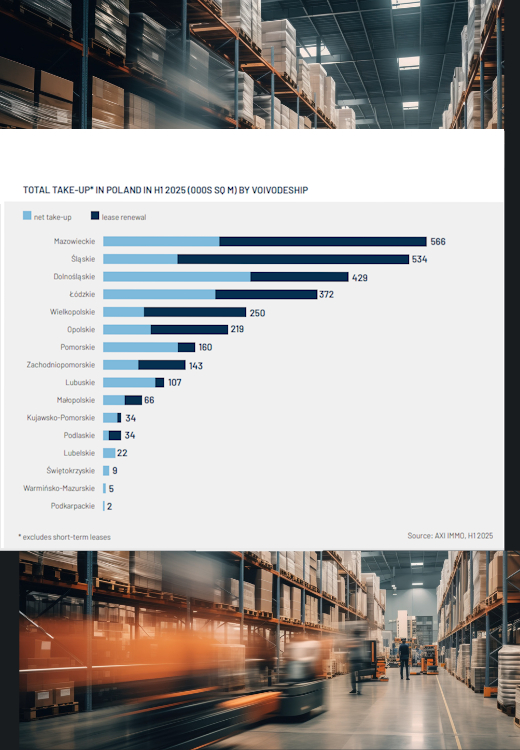

The logistics, manufacturing, and e-commerce sectors are the main drivers of regional demand. In the first half of 2025, 174,000 m² of logistics space was leased (gross take-up; a decrease of ~23% year-on-year), of which 66% consisted of new agreements and expansions (net take-up: 115,000 m²). The average transaction size was one of the highest in Poland at 10,200 m². The most significant lease agreements related to centres in Szczecin, Stargard, and Goleniów.

At the end of June 2025, the vacancy rate dropped to 2.8% – one of the lowest levels in the country, following a dynamic fall in space availability over the last 12 months. Asking rents in new projects and key locations remain stable at €4.10–€4.75/m²/month. The lowest rents can be found in Stargard, while the highest apply to new developments in Szczecin. Lease terms are similar to the national average, and landlords are offering fairly broad incentive packages for tenants signing large or long-term contracts.

The West Pomeranian Voivodeship attracts not only Polish but also foreign developers. Investment activity is concentrated on big-box, BTS, and warehouse projects that support rapid transhipment and international distribution. Developers such as Panattoni, LemonTree, EQT Exeter, and Mapletree are carrying out new investments, with plans for further expansion near key routes and ports.

The growth in regional activity is driven by the development of road infrastructure, access to a skilled workforce, and proximity to Western markets. The West Pomeranian region is a hub for companies serving both north-western Poland and Germany/Scandinavia.

Data comes from the Axi Immo Report - The Warehouse Market in Poland in H1 of 2025.

Contact

Anna Gawrońska

Industrial & Logistics