How to make savings on office space in Warsaw?

How to make savings on office space in Warsaw? The situation in the Warsaw office market. Warsaw Map with rents in individual districts.

The situation in the Warsaw office market over the coming months will undoubtedly be interesting. Businesses will need to adapt to more stringent health and safety requirements in the workplace. For some occupiers, it is time to make decisions about their continued presence in current locations. Moreover, a more widespread remote working model will provoke a re-thinking of staffing policies and determine how much office space is required. Which option would be better – a larger office allowing for safe distances between workstations, a smaller one with a hot-desking system, or a hybrid of the two whereby the current office remains in use but is complemented with coworking space? A company’s current and expected financial situation will have an impact on its final decision, and the key factor will be the level of rent. How do office rents for A-class and B-class buildings currently compare across Warsaw’s districts? The AXI IMMO advisory firm decided to investigate.

– We expect a more difficult economic situation to result in a higher number of tenants initiating negotiations with their landlords. This may result in lower effective rents and higher incentives. We will see a shift from a landlord’s market to an occupier’s market. More affordable locations outside the city center, such as Mokotów or Ochota, may benefit from the new market conditions. The quality of offices in those districts is often not dissimilar to buildings in the prestigious city center – says Martin Lipiński, Office Space and Tenant Representation Director at AXI IMMO.

Rental rates on the office market in Warsaw

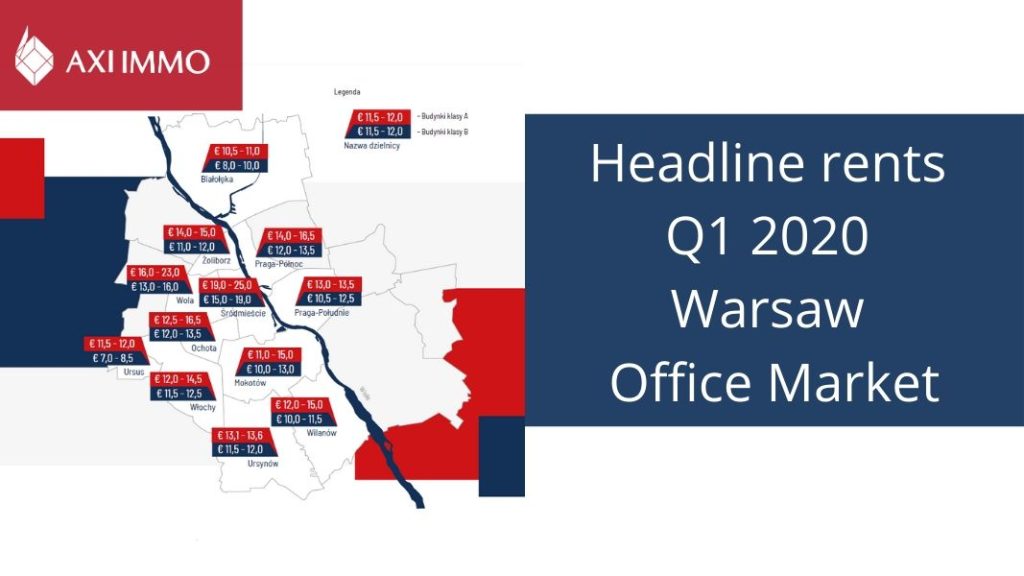

The most expensive location in terms of headline rents for A-class buildings is the City Centre at EUR 19-25/sqm, followed by Wola at EUR 16-23/sqm and – somehow surprisingly – Praga Północ at EUR 14-16.5/sqm. The top 2 are the same for B-class buildings, with the City Centre at EUR 15-19/sqm and Wola at EUR 13-16/sqm. The third spot in terms of B-class rent is shared by Praga Północ and Ochota with both fetching EUR 12-13.5/sqm. The cheapest A-class office space is available in Białołęka at EUR 10.5-11/sqm while Ursus offers the most affordable B-class offices at just EUR 7-8.5/sqm. Mokotów – the largest office district in Warsaw – ranks towards the end of the list for both A-class (EUR 10-13) and B-class (EUR 10-13) rents.

Warsaw map of office headline rents

– We decided to map rents in Warsaw according to the city’s administrative districts, instead of following real estate zones as per the industry standard. This allowed us to illustrate current rents for modern class A and class B office space in a more precise and transparent way. Focussing on districts allowed us to reveal that areas of the city that are associated with affordable rents are in fact among the most expensive ones for both class A and class B assets, as exemplified by Praga Północ – says Bartosz Oleksak, Office Negotiator at AXI IMMO.

– Mokotów is still a very attractive office location, with rents at low levels compared to other Warsaw districts. Large existing office infrastructure and ongoing improvements to public transport may encourage a number of companies to consider this location – adds Bartosz Oleksak.

Demand and supply for offices in Warsaw

Total take-up on the Warsaw office market over the last two years reached over 1.7m sqm (860,440 sqm in 2018 and 878,000 sqm in 2019). Although take-up remained robust in Q1 2020, with a total of 138,900 sqm leased, the upcoming months look less positive due to the knock-on effects of COVID-19 and the lockdown measures. The high demand seen in 2018 and 2019 is partly related to the occupation of new office space planned for 2020-21. Given the projects in the pipeline, the Daszyński roundabout should become the largest business district in Warsaw, with some of the largest occupiers already present or planning to move to that part of the city. This year, according to developers’ announcements, we can expect approx. 343,000 sqm of new completions, 75% of which is already pre-let. The largest schemes planned to open this year are Golub GetHouse’s Mennica Legacy Tower with 66,000 sqm, further phases of Ghelamco’s Warsaw HUB B and C with 61,000 sqm, Karimpol’s Skyliner with 44,000 sqm and Cavatina’s Chmielna 89 with 26,000 sqm. Assuming no delays in 2020, the pipeline for 2021 currently stands at 400,000 sqm.

What future of the ‘After Covid’ office market?

– We are facing a few very interesting months on the Polish office market.Cost-cutting in a number of companies – triggered by lower financial results in H1 2020 – may result in renegotiations of pre-let contracts or partial sub-letting of space. We expect landlords to be flexible with regards to negotiations of new lease negotiations as well as renegotiations of existing leases. They are likely to cover a share of the fit out costs, offer longer rent-free periods and in the most extreme cases also shorten lease lengths – says Tomasz Marsz, Corporate Clients Director for Office Space at AXI IMMO.

About AXI IMMO

AXI IMMO offers consulting services in the field of commercial real estate, including the rental and management of warehouse and office space, as well as the purchase and sale of investment land. As part of the offer, the company provides B2B and B2C chain management services. The company conducts market analyses (see New office investments in Warsaw 2019-2021) and provides reports on the commercial real estate market.

AXI IMMO’s biggest advantage is the combination of international service standards with reliable knowledge of the local market. The company received the title of the best Local Agency of the Year in the years 2012 – 2019 in the prestigious CiJ Awards competition organized by the CEE CiJ Journal and the award for the Best Team in the warehouse sector in 2016-2017.

Recent articles

15 April 2024

UNIQ LOGISTIC stays in Kutno, AXI IMMO real estate agency advises

UNIQ LOGISTIC stays in Kutno, central Poland, in the Kutno Logistics Centre. The tenant was advised by AXI IMMO

27 March 2024

MR D.I.Y. advised by AXI IMMO rents a warehouse at Hillwood Zgierz I, Central Poland

Almost 5,000 sq m for the logistics headquarters of MR D.I.Y. in Central Poland

26 March 2024

Warsaw’s Bliska Wola as a model example of a modern office district

AXI IMMO, the largest Polish real estate agency on the commercial real estate market, presents a special publication "What sets the tone for the Warsaw office market?"

12 March 2024

The latest AXI IMMO report: Industrial Market in Poland 2023

The Industrial market in Poland in 2023 – slower, but not weaker