AXI IMMO / Warehouses / Kraków / Targowisko /

Warehouse Targowisko

Warehouse and production hall with office space

Commercial property consisting of a warehouse, production hall and office part is located in Targowisko. The building with an area of 3912.70 sq m is located on a plot of 12,700 sq m with direct access to national road no. 94. Fenced area. Warehouse with great investment potential.

Possibility of purchasing the hall with the tenant.

Two-story office with social area

Attractive location at DK 94 and close to A4

Independent building with the possibility of expansion

10 m high

Heating

The location is part of the Poland Investment Zone program (formerly Special Economic Zones). This allows investors to benefit from corporate/personal income tax exemptions (CIT/PIT) for a period of 10–15 years, covering up to 70% of the planned investment value. We encourage you to contact us for more details.

Location

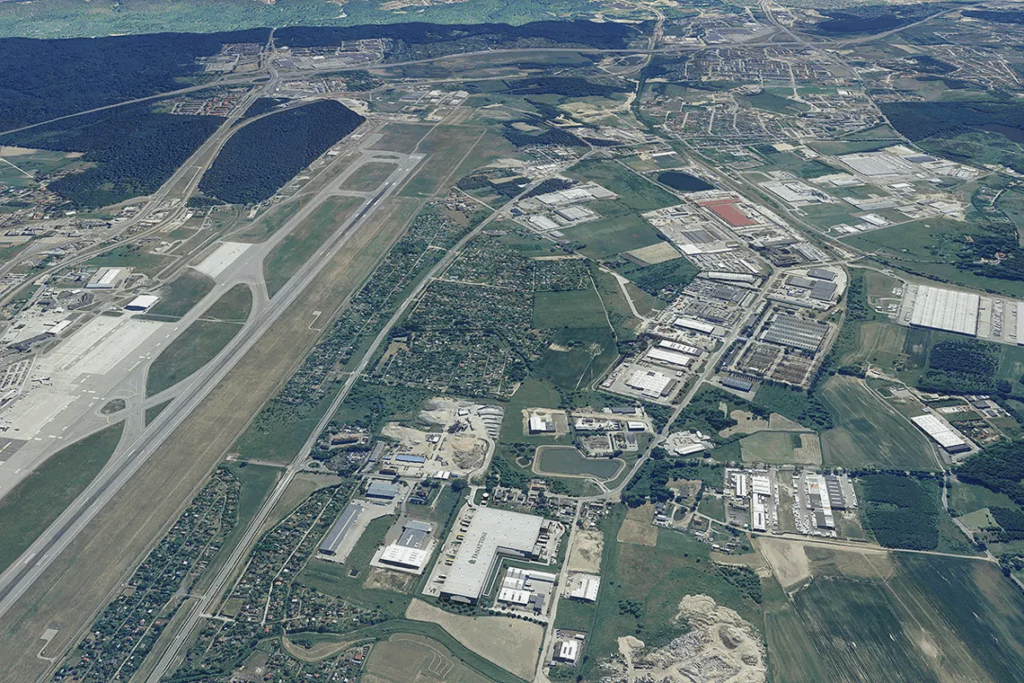

Property located in Targowisko, Małopolska Voivodeship, Wieliczka County. The immediate surroundings are areas of dispersed production, service development and green areas. The advantage of the location is the proximity of the A4 and quick access to Krakow. This location allows investors to benefit from corporate/personal income tax exemptions (CIT/PIT).

Technical data

- Number of buildings1

- Possibility of productionYES

- CertificateNO

- Storage height (m)10

- Floor load capacity-

- Column grid-

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance-

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)-

- Minimal space (sq m)3912

- Roof SkylightsYES

- SprinklersNO

- MonitoringYES

- SecurityNO

- Offer IDmp12390

Distances

Market data

The warehouse market around Krakow (South Poland) has for years been one of the regions that have a low volume of space ready for immediate lease. At the end of the first half of 2025, the vacancy rate is 3.3%. Warehouse developers in search of investment land have decided to expand towards the east, for example in locations such as Kokotów, Wieliczka, Niepołomice, Bochnia, Brzesko, or Tarnów. In the Kraków area, significant warehouse locations include Kraków Nowa Huta, Kraków Rybitwy, Krakow Balice, Skawina, Modlniczka, Myślenice, Targowisko, Cholerzyn, Kryspinów, and Olkusz.

Kraków and the Małopolska warehouse market – a dynamically developing logistics sector in south-eastern Poland

Małopolska, with Kraków as the main centre, is a region with limited modern warehouse space, characterised by a very low vacancy rate and stable tenant demand.

Thanks to its convenient location and proximity to the A4 motorway and S7 expressway, the Kraków area is an attractive place for companies involved in distribution and manufacturing.

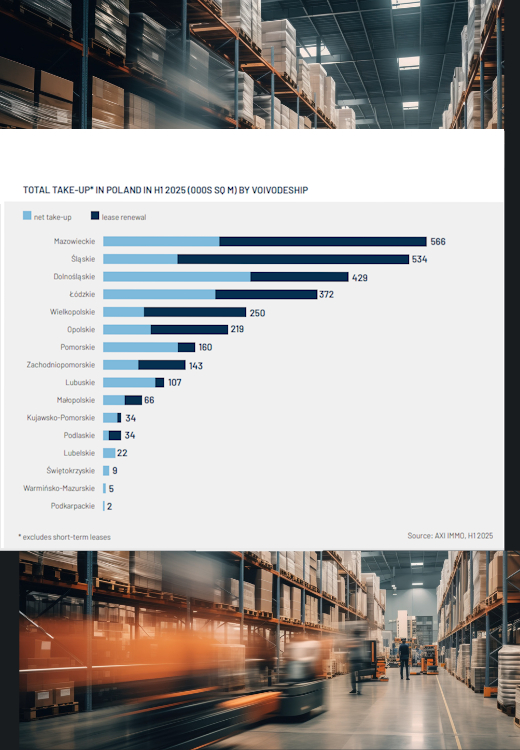

In the first half of 2025, 66,000 sq m of modern logistics and production space (gross demand) was leased in the Małopolskie voivodeship. This was clearly less than in other developed regions of the country.

Clients and investors appreciate the Kraków warehouse market due to the region’s position at the intersection of key transport routes – the A4 motorway and the S7 expressway, as well as the proximity to the Kraków-Balice international airport, which enables rapid distribution of goods.

Both Polish and international logistics companies, retail chains, clothing companies, manufacturers from the furniture/DIY and light production sectors, as well as the e-commerce sector and companies serving it, locate their warehouses and distribution centres in the Kraków area. However, the presence of the e-commerce sector is limited due to low space availability.

Warehouses for Rent in Kraków, the Kraków Agglomeration, and the Entire Małopolska Region

Warehouses and halls in the Kraków region and the Małopolskie voivodeship are marked by very low availability, and rents remain at a high level due to the limited supply. All available modern warehouses and halls in this region meet the highest standards, making them attractive solutions for tenants seeking efficient logistics space.

Many developers, such as Panattoni, 7R, GLP, Hillwood, as well as local entities such as LCube and BIK, are present in the Małopolskie region, supplying both large-scale big-box warehouses and smaller SBU (Small Business Unit) modules. Developers also undertake BTO (built-to-own) and BTS (built-to-suit) projects to meet tenant needs.

At the end of June 2025, the vacancy rate for warehouse and production space immediately available for rent in the Małopolskie voivodeship was only 3.3% – one of the lowest in the country. Meanwhile, 41,000 sq m of warehouse and production space was under construction in and around Kraków.

The above data comes from the AXI IMMO report ‘Warehouse Market in Poland H1 2025’.

Contact

Marta Nowik

Director Industrial & Logistics