AXI IMMO / Warehouses / Poznań / Swarzędz /

Swarzędz Logistic Center CLIP

Waterhouse space to lease near Poznan

Swarzędz Logistic Center CLIP comprises high standard warehouse spaces to let situated near Poznań, in a special economic zone.

A class warehouse space

Profile: warehousing, services and production

Parking spaces for cars and trucks

Clear height: 10,5 m – 13 m

ESFR sprinkler system

Floor loading: 5 t/sq m

Loading ramps

Gas heating

Warehouse space can be arranged and modified according to clients’ needs

Access to the railway siding.

Location

Swarzedz is a city in the metropolitan area of Poznan, in Western Poland; Warehouse park is situated in a special economic zone; In the proximity of the road no. 92; 3 km to junctions of the E30, the S11 and the A2 roads.

Technical data

- Number of buildings10

- Possibility of productionNO

- CertificateNO

- Storage height (m)-

- Floor load capacity

- Column grid-

- Railway sidingNO

- Fire resistance-

- DocksNO

- Ground level access doorsNO

- Cold store/freezerNO

- Minimal space (sq m)-

- Roof SkylightsNO

- SprinklersNO

- MonitoringNO

- SecurityNO

- Offer IDmp10218

Distances

Market data

Poznań belongs to the so-called the big five largest warehouse markets in Poland. It is one of the oldest logistic regions, formed along the 92 National Road and the A2 Highway now. This route enables the distribution of goods from East to West Europe towards Berlin.

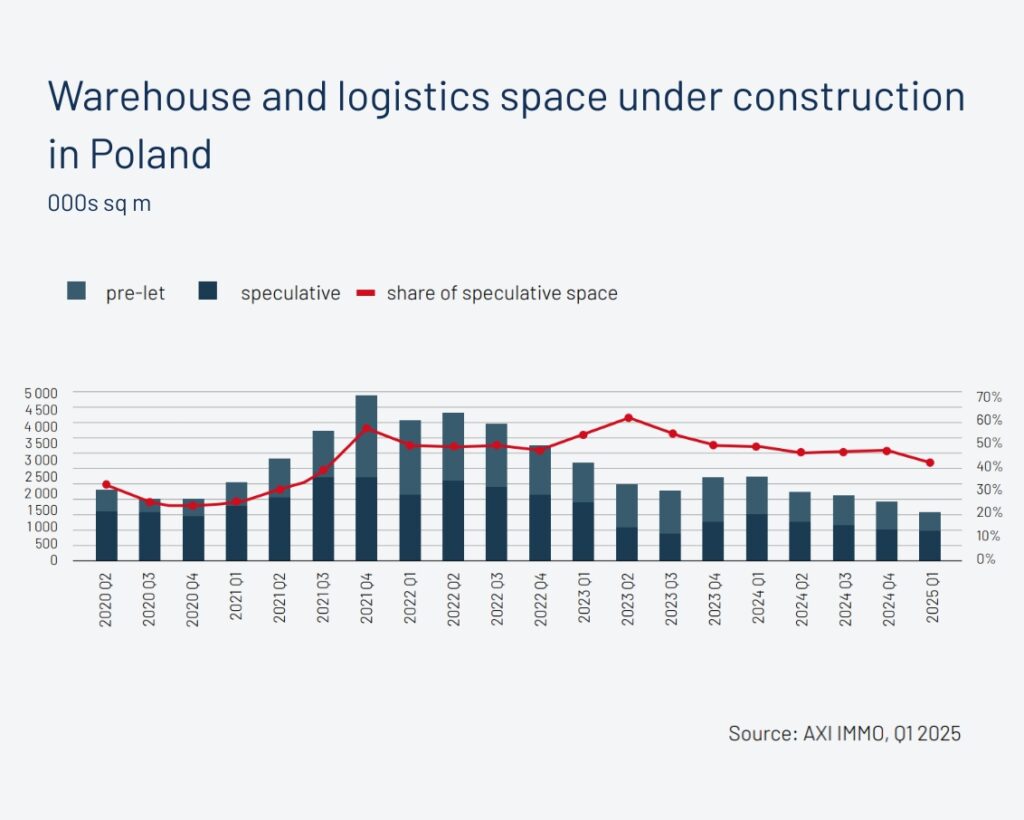

The total resources of the Poznań warehouse market at the end of March 2025 reached approximately 3.60 million m² (estimating based on an increase of 60,000 m² in Q1 2025 compared to the previous value of 3.54 million m² at the end of 2024). In the Greater Poland Voivodeship, all key developers have been active – including Panattoni, 7R, GLP, WhiteStar, Logicor, Hillwood, CTP, MLP, Segro, Hines, Prologis, P3, and many smaller local investors. From January to March 2025, new supply in the region totaled 60,000 m², which was the third largest increase in the country after Lower Silesia and Silesia. The vacancy rate in the region remained at a moderate level of around 8-9%, which is close to the national average of 8.5%. At the end of Q1 2025, nearly 98,000 m² was under construction in the Greater Poland Voivodeship.

The largest clusters of modern industrial-logistics space outside of Poznań itself are located along the expressways S5 and S11, as well as near the airport. Notable locations include Gądki, Żerniki, Jaryszki, Robakowo, Komorniki, Plewiska, as well as developing areas in Sady, Gołuski, Tarnowo Podgórne, and historically known logistics points such as Swarzędz, Konin, Kalisz, and Niepruszewo. Demand in the region remains at a high level. All types of facilities dominate – from big-boxes, through BTS/BTO, to SBU, addressing the needs of logistics operators, e-commerce companies, manufacturing, trade, and courier firms.

Data comes from the Axi Immo Report - The Warehouse Market in Poland in 1Q of 2025.

Contact

Piotr Roszkowski

Associate Director Industrial & Logistics