AXI IMMO / Warehouses / Kraków / Myślenice /

Modern logistics center

Warehouse spaces in Myślenice

The building consists of warehouse space – 3,575 sq. m. with the possibility of division, and office space – 600 sq. m. divided into 3 modules. Possibility of production.

Storage height: 8 m

Floor loading: 5 t/sqm.

Column grid: 18 x 32 m

150 parking spaces

Monitoring

Property fenced

Location

The property is located in Myślenice, less than a kilometer from the S7 road. The location provides quick access to Krakow and the airport in Balice, which provides favorable conditions for the distribution of goods in the country and abroad.

Technical data

- Number of buildings1

- Possibility of productionNO

- CertificateNO

- Storage height (m)-

- Floor load capacity5.0

- Column grid18 x 32 m

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance-

- DocksYES

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)0.00

- Minimal space (sq m)560

- Roof SkylightsYES

- SprinklersNO

- MonitoringYES

- SecurityNO

- Offer IDmp12164

Developer

JTK Investments

Distances

Market data

The warehouse market around Krakow (South Poland) has for years been one of the regions that have a low volume of space ready for immediate lease. At the end of the first quarter of 2025, the vacancy rate is 4.1%. Warehouse developers in search of investment land have decided to expand towards the east, for example in locations such as Kokotów, Wieliczka, Niepołomice, Bochnia, Brzesko, or Tarnów. In the Kraków area, significant warehouse locations include Kraków Nowa Huta, Kraków Rybitwy, Krakow Balice, Skawina, Modlniczka, Myślenice, Targowisko, Cholerzyn, Kryspinów, and Olkusz.

New warehouses and halls in the Krakow area

From January to March 2025, developers delivered 9,000 square meters of new logistics and production space in the Małopolskie Voivodeship.

In the Krakow region, there are warehouse developers such as Panattoni, 7R, GLP, Hillwood, as well as more local entities like LCube and BIK. The biggest challenge for developers remains the terrain shaping, which increases the costs associated with starting the construction of the investment and also affects the initial rental rates. Outside the capital of Lesser Poland, logistics parks and distribution centres are located in the previously mentioned Skawina, Modlniczka, Rybitwy, Targowisko, and Wieliczka. By the end of the first quarter of 2025, 58 thousand square meters of modern logistics and production space provided by developers will remain under construction in the Małopolskie Voivodeship region.

Małopolskie Voivodeship is a region where tenants can choose from a diverse range of warehouse spaces in formats such as big-box, SBU (small business unit), and BTO (built-to-own) and BTS (built-to-suit) projects. Due to the development of the last-mile logistics segment in Krakow and its surroundings, modules are available within smaller urban investments.

Among the most active tenant groups are, among others, logistics companies, manufacturing firms, clothing companies, retail chains, the furniture/DIY industry, light manufacturing, and the automotive industry. The main advantage of the region is access to the A4 motorway and the S7 motorway. As a result of the development of road infrastructure in Krakow, the areas around Krakow-Balice Airport and Nowa Huta are gaining importance.

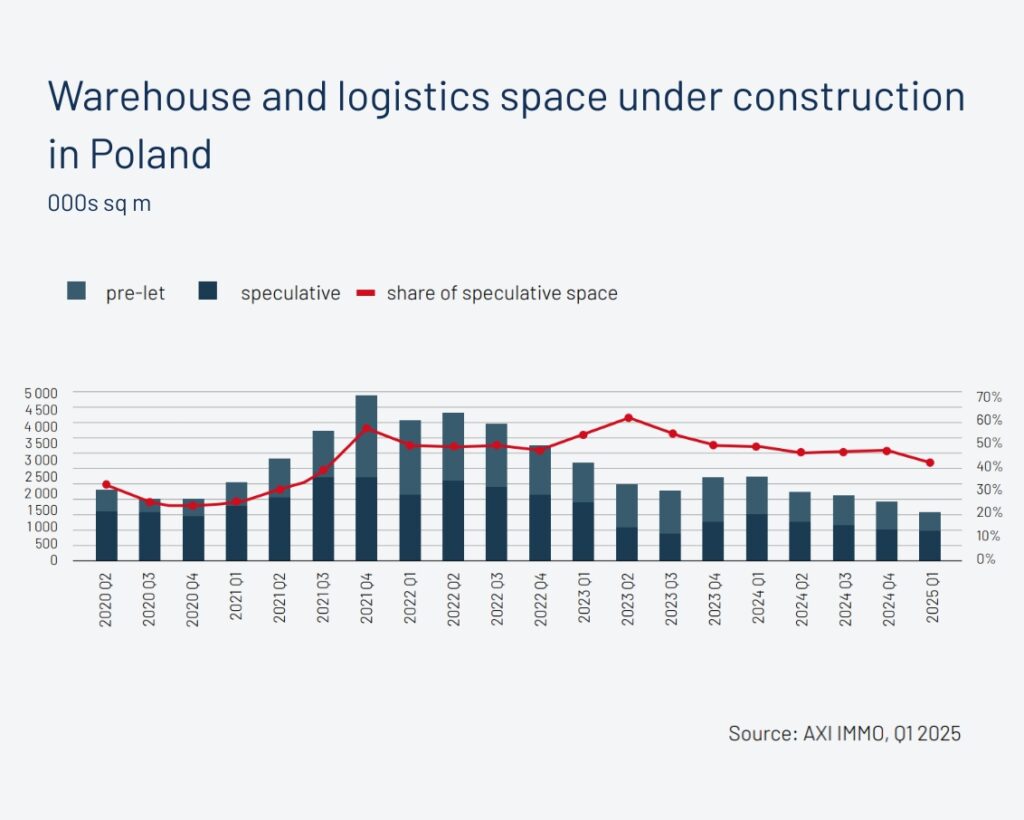

The data presented comes from the AXI IMMO report Polish Industrial and Logistics Market Q1 2025.

Contact

Marta Nowik

Director Industrial & Logistics