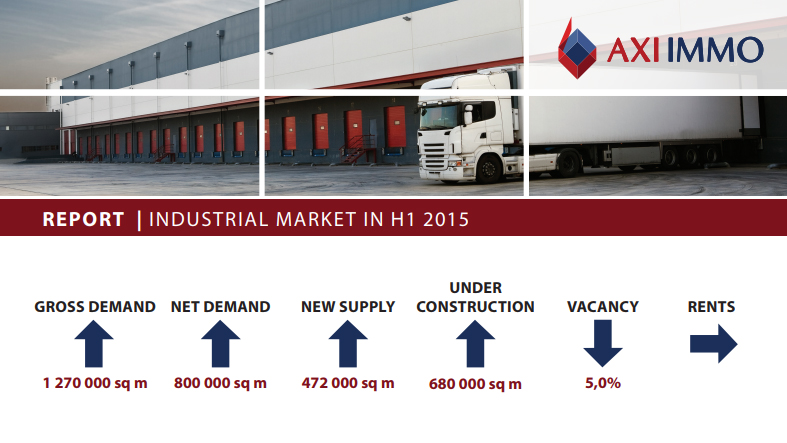

Report – The Industrial market in H1 2015

Good macroeconomic results are positively stimulating the development of the warehouse and production sector in Poland.

Strong demand at a level of 1.27 million sq m and falling vacancy rates in all regions are motivating developers to start new investments not only in mature markets but also in new locations. 680,000 sq m of modern industrial space is currently under construction, of which speculative investments account for 172,000 sq m. Another 100,000 sq m is at the building permit stage.

| Download full report: | AXI IMMO Report Industrial market Poland H1 2015 | Click and read for free: PDF |

Demand

At the end of June, gross demand, i.e. new contracts, expansions and extensions, amounted to 1 270 000 sq m and was about 350,000 sq m higher than in the same period in 2014. 63% of transactions were new leases and expansions of clients’ existing locations. The most amount of space, 270,000 sq m, was leased in the region of Central Poland and in Warsaw. The highest net demand, 164,000 sq m was also recorded in Central Poland, followed by the Poznan region and Upper Silesia. Apart from the main regions, there was a visible increase in demand in new markets such as Lublin and Rzeszów, where a total of more than 100,000 sq m was leased.

The current economic growth is based on fundamentals that are more robust than in previous cycles. Inflation remains low, and we are observing reasonable growth in credit and a declining deficit in the current account, as well as stable growth in private consumption which is indirectly affecting the rapid development of the industrial property market in Poland, said Renata Osiecka, Managing Partner at AXI IMMO. The large portion of new demand is generated by companies from the end consumer market. We estimate that at the end of the year, net demand may be similar to last year’s record and exceed 1.4 million square metres, commented Renata Osiecka, Managing Partner at AXI IMMO.

In the structure of demand in the first half of the year, logistics operators, as usual, had the largest share (33%), but it is worth noting that companies from the home&interior and electronics sectors had a higher share than in previous years, with 17% and 13% respectively of total demand recorded.

Supply

In the first half of the year, 472,000 sq m were completed. This is an increase in supply by 58% compared to the same period last year. The largest share of which was, 182,000 sq m in the Poznan region within 5 investments.

We observe a high level of activity among developers, with more than 680,000 sq m of modern warehouse space under construction, of which over 170,000 sq m is speculative space. Compared with the same period last year, the volume of speculative space is realized is over two times as high. In addition worth to mention that besides a large number of projects under construction, developers possess secured land for new investments in almost every market. This applies to mature markets such as Warsaw or Poznan, but also new locations such as Bydgoszcz and Lublin, added Renata Osiecka Managing Partner at AXI IMMO.

Vacancy rate

At the end of the second quarter 2015, the vacancy rate was 5%. This is a decrease of 0.7% from the first quarter of this year. In annual terms, it has fallen by 5.4%, and historically it is now at its lowest average rate. 480,000 sq m is currently available for lease. Availability in all regions has fallen below 10%. The most amount of free units remain in Warsaw (9.7%) and the surrounding region (9.5%), followed by Upper Silesia. The lowest vacancy rates, below 3%, are in Poznan and Wroclaw. It should also be noted that part of the space is occupied under short-term contracts, and is not therefore formally counted as leased space.

Rents

In the last six months, rents have remained stable. In subsequent quarters in most markets, transaction rates should remain unchanged, despite the low level of vacant space. We can expect some small increases in Central Poland due to the low availability of space and the lack of speculative investments.

Forecast

In the second half of the year, we expect the high level of development activity to remain unchanged. The low vacancy rate will encourage developers to start new investments, and it is possible that some of them will be speculative projects – mainly in the Warsaw region as well as in new locations after signing pre-let agreements.

In terms of demand, the growth trend should continue, mainly through the development of companies already present in the Polish market. The sectors with the greatest potential for growth remain FMCG, electronics and home&interior, particularly in the e-commerce sales channel.

At current demand and supply growth, especially growth in speculative projects, the vacancy rate should remain stable. Rents are stable with a slight upward trend in selected locations.

Recent articles

23 June 2025

Panattoni Park Warsaw West Błonie near Warsaw, Poland, with a new warehouse for logistics operator

Panattoni Park Warsaw West - key location and modern warehouse spaces

23 June 2025

HSNF renews lease at Prologis Park Poznań I – Beauty sector tenant continues operations in Greater Poland

HSNF continues its logistics operations in Poland in Poznan region

25 May 2025

UrbanBox Park Komorniki – modern small-scale warehouse space for growing businesses, near Poznan, Western Poland

Urbanbox Park Komorniki warehouse complex with modules from 167 sq m. in a strategic location near Poznań.

15 May 2025

AXI IMMO market report: Poland’s Industrial & Logistics Market Q1 2025

AXI IMMO presents its latest market report "Polish Industrial and Logistics Market Q1 2025."