Report: What will happened with rents on warehouse market? Will the rents rise?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

Rents for warehouse space in 2016

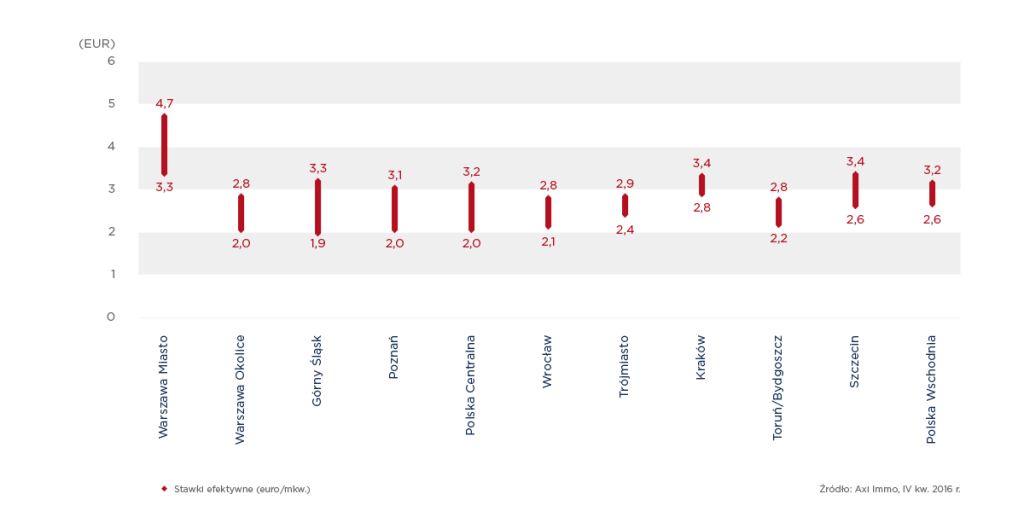

In 2016 the most attractive effective rents were obtainable in the Warsaw area (EUR 1.90-2.40/sq m) and in selected locations in Upper Silesia and Poznan. Rents for warehouse space remained low and stable in the regions because of the numerous projects under construction and competition between developers.

Quite high rates, within the range of EUR 2,50-3,20 sq m/month were found in Lodz and the Bielsko-Biala sub-region. Due to the small supply of investment plots and strong competition from other commercial sectors, Krakow is also one of the most expensive logistic hubs. The rents are keeping on a level above EUR 3.00/sq m in this location.

The rent for the warehouse in 2017 – Will the rents rise?

Renata Osiecka, Managing Partner at AXI IMMO, point out that the opportunity to negotiate rates depends on owner type and stage of the project. In most locations where existing facilities are managed through investment funds, the ability to negotiate rates below market averages is limited. It is different in the case of new facilities where the developer wants to have a pre-let agreement to start a new building or to close a project when the last unit remains free. In this case, the scope for rent holidays and financial incentives for tenants is generally larger.

In 2017 rents on the Polish industrial market are expected to remain stable. Currently, there are 1.3 million square metres under construction, of which 27% are speculative investments. This projects might limit pressure on increasing effective rental rates.

Further information about warehouse rents and Polish industrial market is given in the AXI IMMO’s report:

⇓ Industrial market in Poland – summary 2016 PDF|2 MB

Recent articles

5 February 2026

Report: Warsaw Office Market in 2025 and forecasts for 2026. AXI IMMO publishes the latest data, February 2026

Discover the latest insights into the Warsaw office market in 2025, including key trends, leasing activity, and predictions for 2026. Read AXI IMMO’s comprehensive February 2026 report for data on office space take-up, rental rates, and market growth.

4 February 2026

AXI IMMO advises Nowa Szkoła on renegotiations and expansion of logistics and office space in Łódź CELH

Nowa Szkoła extends lease and expands at Central European Logistics Hub in Łódź.

8 January 2026

Poland’s Industrial Market in 2025:Supply stabilisation, strong take-up and a shift in transaction structure

AXI IMMO Forecast: The Polish Warehouse Market on the Threshold of 2026: Check the Analysis on Supply, Tenant Activity, and Rents.

17 December 2025

Warsaw Office Market in 2025: Lower New Supply, Higher Quality

AXI IMMO provides estimates for the Polish office real estate market at the end of 2025. What challenges did the office market face?