How to make savings on office space in Warsaw?

How to make savings on office space in Warsaw? The situation in the Warsaw office market. Warsaw Map with rents in individual districts.

The situation in the Warsaw office market over the coming months will undoubtedly be interesting. Businesses will need to adapt to more stringent health and safety requirements in the workplace. For some occupiers, it is time to make decisions about their continued presence in current locations. Moreover, a more widespread remote working model will provoke a re-thinking of staffing policies and determine how much office space is required. Which option would be better – a larger office allowing for safe distances between workstations, a smaller one with a hot-desking system, or a hybrid of the two whereby the current office remains in use but is complemented with coworking space? A company’s current and expected financial situation will have an impact on its final decision, and the key factor will be the level of rent. How do office rents for A-class and B-class buildings currently compare across Warsaw’s districts? The AXI IMMO advisory firm decided to investigate.

– We expect a more difficult economic situation to result in a higher number of tenants initiating negotiations with their landlords. This may result in lower effective rents and higher incentives. We will see a shift from a landlord’s market to an occupier’s market. More affordable locations outside the city center, such as Mokotów or Ochota, may benefit from the new market conditions. The quality of offices in those districts is often not dissimilar to buildings in the prestigious city center – says Martin Lipiński, Office Space and Tenant Representation Director at AXI IMMO.

Rental rates on the office market in Warsaw

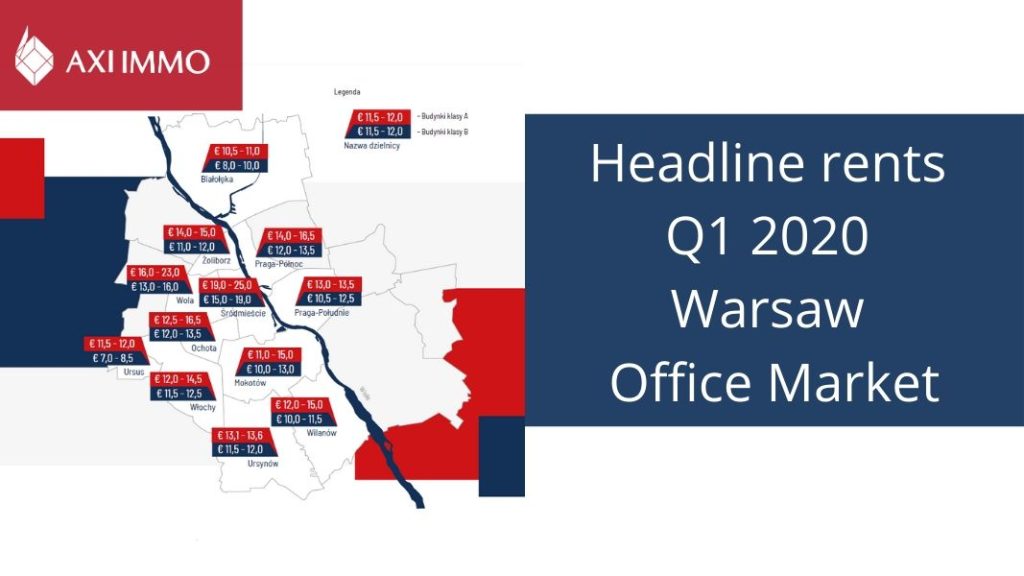

The most expensive location in terms of headline rents for A-class buildings is the City Centre at EUR 19-25/sqm, followed by Wola at EUR 16-23/sqm and – somehow surprisingly – Praga Północ at EUR 14-16.5/sqm. The top 2 are the same for B-class buildings, with the City Centre at EUR 15-19/sqm and Wola at EUR 13-16/sqm. The third spot in terms of B-class rent is shared by Praga Północ and Ochota with both fetching EUR 12-13.5/sqm. The cheapest A-class office space is available in Białołęka at EUR 10.5-11/sqm while Ursus offers the most affordable B-class offices at just EUR 7-8.5/sqm. Mokotów – the largest office district in Warsaw – ranks towards the end of the list for both A-class (EUR 10-13) and B-class (EUR 10-13) rents.

Warsaw map of office headline rents

– We decided to map rents in Warsaw according to the city’s administrative districts, instead of following real estate zones as per the industry standard. This allowed us to illustrate current rents for modern class A and class B office space in a more precise and transparent way. Focussing on districts allowed us to reveal that areas of the city that are associated with affordable rents are in fact among the most expensive ones for both class A and class B assets, as exemplified by Praga Północ – says Bartosz Oleksak, Office Negotiator at AXI IMMO.

– Mokotów is still a very attractive office location, with rents at low levels compared to other Warsaw districts. Large existing office infrastructure and ongoing improvements to public transport may encourage a number of companies to consider this location – adds Bartosz Oleksak.

Demand and supply for offices in Warsaw

Total take-up on the Warsaw office market over the last two years reached over 1.7m sqm (860,440 sqm in 2018 and 878,000 sqm in 2019). Although take-up remained robust in Q1 2020, with a total of 138,900 sqm leased, the upcoming months look less positive due to the knock-on effects of COVID-19 and the lockdown measures. The high demand seen in 2018 and 2019 is partly related to the occupation of new office space planned for 2020-21. Given the projects in the pipeline, the Daszyński roundabout should become the largest business district in Warsaw, with some of the largest occupiers already present or planning to move to that part of the city. This year, according to developers’ announcements, we can expect approx. 343,000 sqm of new completions, 75% of which is already pre-let. The largest schemes planned to open this year are Golub GetHouse’s Mennica Legacy Tower with 66,000 sqm, further phases of Ghelamco’s Warsaw HUB B and C with 61,000 sqm, Karimpol’s Skyliner with 44,000 sqm and Cavatina’s Chmielna 89 with 26,000 sqm. Assuming no delays in 2020, the pipeline for 2021 currently stands at 400,000 sqm.

What future of the ‘After Covid’ office market?

– We are facing a few very interesting months on the Polish office market.Cost-cutting in a number of companies – triggered by lower financial results in H1 2020 – may result in renegotiations of pre-let contracts or partial sub-letting of space. We expect landlords to be flexible with regards to negotiations of new lease negotiations as well as renegotiations of existing leases. They are likely to cover a share of the fit out costs, offer longer rent-free periods and in the most extreme cases also shorten lease lengths – says Tomasz Marsz, Corporate Clients Director for Office Space at AXI IMMO.

About AXI IMMO

AXI IMMO offers consulting services in the field of commercial real estate, including the rental and management of warehouse and office space, as well as the purchase and sale of investment land. As part of the offer, the company provides B2B and B2C chain management services. The company conducts market analyses (see New office investments in Warsaw 2019-2021) and provides reports on the commercial real estate market.

AXI IMMO’s biggest advantage is the combination of international service standards with reliable knowledge of the local market. The company received the title of the best Local Agency of the Year in the years 2012 – 2019 in the prestigious CiJ Awards competition organized by the CEE CiJ Journal and the award for the Best Team in the warehouse sector in 2016-2017.

Recent articles

5 February 2026

Report: Warsaw Office Market in 2025 and forecasts for 2026. AXI IMMO publishes the latest data, February 2026

Discover the latest insights into the Warsaw office market in 2025, including key trends, leasing activity, and predictions for 2026. Read AXI IMMO’s comprehensive February 2026 report for data on office space take-up, rental rates, and market growth.

4 February 2026

AXI IMMO advises Nowa Szkoła on renegotiations and expansion of logistics and office space in Łódź CELH

Nowa Szkoła extends lease and expands at Central European Logistics Hub in Łódź.

8 January 2026

Poland’s Industrial Market in 2025:Supply stabilisation, strong take-up and a shift in transaction structure

AXI IMMO Forecast: The Polish Warehouse Market on the Threshold of 2026: Check the Analysis on Supply, Tenant Activity, and Rents.

17 December 2025

Warsaw Office Market in 2025: Lower New Supply, Higher Quality

AXI IMMO provides estimates for the Polish office real estate market at the end of 2025. What challenges did the office market face?